CEE

Q&A: Hermes GPE's Elias Korosis

Unquote speaks to the LP's head of growth investing about gaining access to the best deals and being a good partner to GPs

Average holding period stays high as quick exits lag

Lower proportion of deals are being exited within three years, and more after seven years

Ukraine-based Horizon Capital's Rozetka bolts on Evo

E-commerce specialist Rozetka, owned by Horizon Capital since 2015, bolts on Evo

Q3 Barometer: European PE's strongest third quarter

European market had its most active third quarter on record in 2018 in terms of dealflow

Innova and Solter invest in Oshee Polska

Poland-based isotonic and mineral drinks producer will pursue an acquisitive growth strategy

Investindustrial's Benvic bolts on Alfa PVC

Company will continue to be managed by its current CEO and co-founder Andrzej Trebicki

Value4Capital acquires Kom-Eko from Royalton

Capital was deployed from V4C Poland Plus Fund alongside participation from co-investors

Single-asset funds afford slow and steady pace

When a fund approaches the end of its lifespan, transferring the last remaining investment into a new vehicle is proving increasingly popular

EI buys stake in Anwim

Investment will be used to finance expansion for Anwim, including the development of its Moya chain

BaltCap invests in Kool Latvija

Investment is drawn from BaltCap Growth Fund, which is currently fundraising with a €50m target

Livonia Partners leads $5.2m series-A for Scoro

Previous backers Inventure and Tera Ventures also take part in the funding round

Abris sells Kopernikus Technology to trade

Sale ends a two-year holding period for Abris, which bought the company via its third fund

Jet closes second fund on CZK 4bn

Jet II is the largest private equity fund in the Czech Republic that is open to international LPs

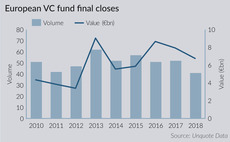

European VC fundraising continues strong showing

VC fundraising totals over 2016-2017 marked a healthy increase of nearly 50% on the amounts raised in the previous two-year period

Horizon backs confectionery maker Yarych

Horizon is currently investing from its $150m Emerging Europe Growth Fund, closed in 2016

Abris buys CADM Automotive for PLN 42.5m

Abris draws capital from Abris CEE Mid Market Fund III to finance the transaction

Pera targets €100m for second fund

New fund will follow the strategy of its predecessor, investing in the Turkish lower-mid-market

PIF commits $500m to RCIF

RCIF is currently considering investing in more than 20 projects, valued at $1bn

CEE fundraising landscape in flux

Despite strong activity in 2017, the fundraising landscape means smaller fund managers are struggling to reach their targets

Mezzanine Management backs Optimapharm with €10m

Transaction marks Mezzanine Management’s first investment in the Croatian market

BaltCap exits InMedica to INVL

Deal marks the seventh exit for BaltCap this year, and the fifth exit for the Lithuania SME Fund

Tar Heel acquires Aludesign

Private equity firm wholly acquired Poland-headquartered Aludesign at the end of September

Secondary buyouts back on the scene in CEE

H1 2018 saw the second highest half-year volume of SBOs since the financial crash, rebounding from two consecutive semesters of low activity

DTCP injects $10m into Pipedrive's $60m series-C

Follow-on round for the CRM software developer comes four months after an initial $50m series-C