DACH

HV Holtzbrinck leads €3.4m round for Productive Mobile

With the fresh seed funding, Productive Mobile intends to bring its product to a wider market

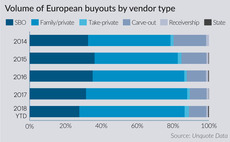

Secondary buyouts hit 10-year low in Q1

Proportion of deals sourced from fellow PE firms has ebbed back to the level last seen in 2007, according to Unquote Data

Hg launches automotive buy-and-build with Mobility Concept deal

GP will merge the company with online car marketplace Meinauto.de, creating Mobility Holding

Lakestar in €16m series-A for Nebenan.de

Round was led by Burda Principal Investments, the investment arm of Hubert Burda Media

Triton appoints Watters to debt opportunities team

In his new role, Gordon Watters will provide operational scrutiny for investments

Odewald buys Heizkurier

GP draws equity from Odewald KMU II, a €200m buyout fund closed in November 2015

VR-backed Hör Technologie buys Pichler & Strobl

Second bolt-on in quick succession after the acquisition of Neustadt-based Fischer CNC-Technik

European entry multiples hit new high in 2017 despite Q4 cooldown

Average EBITDA multiple increased to 10.4x in 2017 compared with 10.2x in 2016, according to the latest Clearwater Multiples Heatmap

Towerbrook-backed Gravity Media buys Genesis Broadcast

Genesis Broadcast Services will be rebranded to Gearhouse Broadcast following the deal

3i sells Scandlines to First State and Hermes in €1.7bn deal

Vendor reinvests for a 35% stake in the Danish-German ferry operator after an 11-year holding

VC firms back $11m series-A for Bestmile

Road Ventures, Partech Ventures, Airbus Venture and Serena Capital also take part

Spark Capital et al. back Tourlane

Consortium of VC firms take part in a €7m series-A round for German travel planning specialist Tourlane

Mega-buyout volumes hit post-crisis Q1 high

Combined with Q4 2017, the past six months have represented the most active consecutive quarters for тЌ1bn-plus buyouts since 2007

Mangrove in $30m funding round for Saga Foundation

Lightspeed Venture Partners, the Singulariteam Technology Group and Initial Capital also take part

Unigestion launches global fund-of-funds

Fund will be targeting mostly primary buyout funds with a small allocation to secondaries

VC firms invest €25m in Geld-für-Flug

Hannover-based Seed + Speed Ventures took part in the round alongside Luxembourg-based EPI

Triton sells stake in Befesa

Shares are valued at approximately €123.9m, based on the share price of €41.30 per share

GP Profile: Triton Partners

Founder Peder Prahl talks to Unquote about the GP's turnaround approach and its funds' more pronounced J curves compared to regional peers

Capnamic leads €4m series-A for Userlane

High-Tech Gründerfonds, Commerzbank's Main Incubator and FTR Ventures also take part

Novalpina holds second close for debut fund

Novalpina's maiden fund, Novalpina Capital Partners I, was announced in May 2017 with a тЌ1bn target

VC-backed N26 raises $160m

Earlybird Venture Capital, Horizons Ventures and Valar Ventures previously backed the business

Triton-backed Glamox buys O Küttel

Acquisition will be used as a platform for Glamox to enter the Swiss lighting market

Ekkio hires Accuracy's Boess

Ekkio Capital aims to bolster its operations in Germany with the new appointment

VC firms sell Prexton to Lundbeck for up to €905m

Vendors include Sunstone Capital, Ysios Capital Partners and Forbion Capital Partners