DACH

Kapa Ventures backs €2.1m seed round for Mything

Kapa takes a majority stake in the business and CEO Florian Mott takes a minority

Afinum buys Garz & Fricke

Founders Manfred Garz and Matthias Fricke will retain a significant stake and remain co-CEOs

Bain, Cinven yield to Elliott's Stada share price demands

Elliott announced last week that it would not support the Stada bid for less than €74.4 per share

Infracapital sells Alticom to Cellnex Telecom

Sale ends a six-year holding period for Infracapital after a buyout valued at $100m in June 2011

Blackstone-backed AAG buys Klapper Autoteile

Andreas Klapper was the company's sole shareholder prior to the transaction and will remain CEO

Atomico in $90m series-B for Lilium

Chinese investment firm Tencent, LGT and Obvious Ventures also take part in the round

Atlantic Labs backs Cara

Anonymous business angels also participated in the round, which will be used to launch the platform

Beringea leads €5m funding round for Smartassistant

Retailing software platform will undertake international expansion with a particular focus on the US

Rocket Internet sells Plinga to Orangegames

Seventure, PD and Klingel also sell their stakes while Spil Games retains its minority stake

DACH region opening up for PE activity in veterinary space

Local regulations surrounding consolidation in the sector have held back PE investment but EU court rulings could bring opportunities

Equistone buys fashion retailer DefShop

GP secures a majority stake from the founder of the business, who will retain a minority

Capvis makes final exit from VAT Group

Capvis placed the shares with institutional investors through an accelerated book-building

Elliott demands €74.4 per share to support Stada takeover

Hedge fund Elliott Management held a stake of 11.43% in the company as of 28 August

Cherry Ventures in €4m round for Homelike

Existing investor Coparion has also participated in the round, which will fund recruitment

VC firms back €10m seed round for Coya

Angel investors Mato Peric, Rolf Schrömigens, Elvir Omerbegovic and Marco Knauf also invest

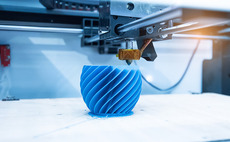

BayBG backs German RepRap

BayBG will acquire a minority stake in the company, which remains majority owned by its founders

DBAG hires Robert Schmidt as partner

Schmidt will provide support to the DBAG investment team in selecting and reviewing investments

Waterland holds €2bn final close

Dutch buyout private equity firm closes its seventh fund two months after launching in July 2017

HTGF leads seed round for DeviceTrust

Deal for software developer is the fifth German investment made by the VC in August 2017

EQT Ventures leads €3m seed round for Home

EQT Ventures has invested around 90% of its Europe-focused maiden fund to date

HTGF backs WhatsBroadcast in €5m series-A

Investors include Müller Medien, Media + More Ventures, Wessel Management and minority shareholders

Bain and Cinven nearing deal completion for Stada

Five members of Stada's supervisory board have resigned as a result, stating their task is complete

B-to-V leads €6.5m series-A for Seven Senders

Reno Kohler, founder of Internetstores, also participated in the round alongside existing investors

Sun European's Bösenberg joins Quadriga

Bösenberg left Sun European Partners in late June, triggering the closure of the GP's Frankfurt office