DACH

VCs sell Therachon to Pfizer for $810m

Pfizer will acquire Therachon for $340m with $470m in additional, conditional payments

Notion Capital leads $12m series-A for HeyJobs

Notion Capital typically leads funding rounds with a first investment of $3-5m in startups

KGAL to invest in private equity and expand investor base

KGAL has 72,000 investors from Germany, the UK and France, of which 211 are institutional investors

European direct lending up 9% but turbocharged growth wanes

Rate of growth in alternative debt deals slows from 32% in 2017, according to Deloitte's Alternative Lender Deal Tracker

Afinum exits Sinnex in trade sale

Afinum has already realised two investments from its Fünfte vehicle: CaseKing and D&B

Maxberg acquires Starface

Maxberg invests €10-100m in companies in the DACH region and has a total fund volume of €600m

Panakès Partners in CHF 9.5m round for SamanTree

Panakès Partners is using equity from its Fund I, which invests €5-6m in European startups

Sequoia, Spark Capital lead $47m series-C for Tourlane

Existing investors in Tourlane include NFQ Capital, DN Capital and HV Holtzbrinck Ventures

Unquote Private Equity Podcast: Karmic balance sheets

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses recent developments in the impact investment space

Capvis-backed Wer Liefert Was bolts on Gebraucht.de

Business angels including Peter Schmid, Kai Hansen, Marcus Börner and Jan Kemper were investors

Capiton Acquires GPE Group

GPE Group is the ninth company in Capiton V's portfolio, which includes BWTS and Ispin

IK-backed Schema acquires Tid Informatik

As a new wholly-owned subsidiary of Schema, the company will operate as an independent business

VC firms in $30m series-B for logistics specialist Freighthub

Maersk Growth, Northzone, Unbound, GFC and Cherry Ventures also take part in the investment

DBAG invests in Cloudflight

DBAG has co-invested approximately €8m from its balance sheet, for a 12% stake in Cloudflight

H&F, Blackstone's take-private of Scout24 stalls – reports

Shareholders resist a voluntary takeover offer following a rise in Scout24's share price

EQT exits Avenso in management buy-back

EQT acquired a majority stake in Avenso in 2013 and has expanded the company's product portfolio

Marondo Capital acquires stake in Oxid eSales

Current shareholders in Oxid eSales include IBG, Marondo Capital and the company's CEO

Figuring out the ESG middle-ground

How can managers draft a policy that does not result in paralysis by over-analysis?

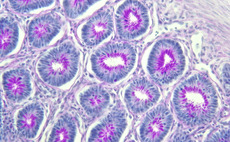

Consortium invests CHF 12.5m in Alentis

BioMedPartners, BB Pureos Bioventures, BPI France, Schroder Adveq and HTGF participate in the deal

DPE invests in Massenberg

DPE is currently investing from DPE Duetschland III, which held a final close on €575m in 2017

VCs sell Parlamind

Investors include Motu Ventures, Asgard Capital, Angelfund.vc and business angels

Nord Holding sells stake in Avista Oil

Family office Bitburger Holding and entrepreneur Susanne Klatten's investment arm acquired the stake

Orlando carves our Nidec's compressor business

Orlando drew capital from the €320m vehicle European Special Situations Venture Partners IV

Unigestion launches second direct investment vehicle

Predecessor fund held a €255m final close in 2017 after 21 months on the road