Nordics

Adelis-backed Søgemedier buys MarkkinointiAkatemia

Fifth bolt-on the group has made since the acquisition of SУИgemedier in February 2018

Agilitas-backed Reconor buys Hedegaard Miljø

Selling shareholder Kim Hedegaard Nielsen will take on responsibility for Reconor international

Via Equity-backed Adform announces IPO

Company aims to raise DKK 750m through new shares in addition to any sale of existing shares

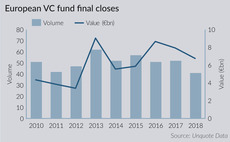

European VC fundraising continues strong showing

VC fundraising totals over 2016-2017 marked a healthy increase of nearly 50% on the amounts raised in the previous two-year period

Tesi et al. in €12m series-A for Dispelix

Previous backers Lifeline Ventures and VTT Ventures also take part in the investment

CapMan holds €115m first close for maiden infra fund

CapMan launched its infrastructure-focused investment business in April 2017

Solix buys Wärtsilä

Carved-out pumps division generated sales of тЌ50m in 2017 and employs 230 people

Hadean Ventures appoints Liberium's Franklin

In his new role, Franklin will focus on investment opportunities in the therapeutics sector

CVC, GRO Capital buy Omada from C5 Capital

GPs will partner with the management team to accelerate the company's expansion and innovation

Agilitas backs Teracom Danmark

Agilitas's Kevin Iermiin will join the board of Teracom Danmark to support the management

EQT to take Karo Pharma private for SEK 6bn

Offer of SEK 36.90 per share is unanimously recommended to shareholders by the board

Ysios Capital, OrbiMed lead €79m series-C for Galecto

HBM, Bristol Myers-Squibb, Maverick Ventures and Seventure Partners also take part in the round

Naxicap's Technicis Group bolts on AAC Global

Finland-based translation services business AAC is Technicis's fourth bolt on in 2018

PE drives Elo's performance

Finnish occupational pension company has allocated 8.3% of its portfolio to private equity

MizMaa Ventures leads $7.5m round for Resolution Games

GP Bullhound and Fly Forever also take part in the round alongside existing investors

Nordic software sector lures private equity investors

Deal volume in the software space outstripped the long-term monthly average throughout September as the region's reputation endures

FSN-backed Bygghemma bolts on Edututor

Edututor will continue to operate as an independent entity within the DIY segment in Finland

Lifeline et al. in €5.1m funding round for Synoste

German early-stage investor HTGF, a previous backer of Synoste also participated in the round

Triton, KKR-backed Ambea to acquire Aleris division for SEK 3bn

Care operations of Aleris in Norway, Sweden and Denmark will be acquired by Ambea for SEK 3bn

Investinor et al. raise $5m for Memory

Previous investor SNУ Ventures also participates in the latest funding round for the tech startup

Velliv hires chief strategist

Henriksen joins from PFA Pension, where he has served as head of strategy since 2009

GIC invests in EQT-backed NAC

Bringing in a new investor will enable NAC to continue its consolidation strategy

Summit invests $67m in Syncron

Investment is intended to facilitate the company's growth and preparations for a future IPO

CapAgro invests SEK15.6m in BoMill

CapAgro is currently investing via its Innovation fund, which held a final close on тЌ124m in 2017