Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Arts Alliance et al. back RollUp Media

Arts Alliance and a group of individual investors have injected тЌ1.2m into UK-based online platform for publishers RollUp Media.

OTPP looking to score Goals Soccer takeover

The Ontario Teachers' Pension Plan (OTPP) is set to buy listed UK-based Goal Soccer Centres, which operates five-a-side football centres, in a deal that values the business at around ТЃ73.1m.

Former Metro boss launches PE house in Germany

Former Riverside partners Kai Köppen and Volker Schmidt have partnered with ex Metro boss Eckhard Cordes and former Apax partner Christian Näther to form a new buyout house in Munich, local reports suggest.

Fondo Italiano injects €5m into Antares

Fondo Italiano di Investmento has acquired a minority stake in Italian artificial vision systems producer Antares Vision via a €5m investment in holding company Imago Technologies.

Via Venture acquires Hostnordic

Via Venture Partners and retail investor Christian Winther have jointly acquired a majority stake in Danish web hosting and IT outsourcing provider Hostnordic.

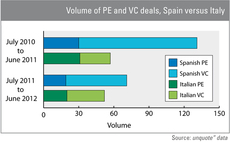

Spain continues to outperform Italy in deal volume

Despite the country's dire economic state, Spanish private equity activity has continued to outpace that of Italy continuously over the past 24 months - although the latter showed more resilience last year.

Gilde Equity Management acquires BlueCielo

Gilde Equity Management has bought Dutch software company BlueCielo from a group of financial and private shareholders.

Renewed confidence in alternative energy

Alternative energy

Sun-backed Neckermann files for insolvency

Sun European Partners' German mail-order portfolio company Neckermann has filed for insolvency following unsuccessful talks with the PE firm.

Inflexion appoints new partner

Inflexion Private Equity has promoted Richard Swann from investment director to partner.

A Capital in DKK 185m PIPE for Bang & Olufsen

A Capital and Chinese luxury retailer Sparkle Roll have invested DKK 185m for a 7.71% stake in listed Danish high-end audio-video business Bang & Olufsen.

HTGF et al. invest €1m in Data Virtuality

High-Tech Gründerfonds (HTGF) and Technologiegründerfonds Sachsen (TGFS) have invested €1m in German software start-up Data Virtuality.

Coller's sixth fund hits $5.5bn final close

Coller Capital has held a final close for its sixth fund on $5.5bn, exceeding its original $5bn target.

Perfectis exits Fasia Industries in trade sale

Perfectis Private Equity has sold its majority stake in French professional clothing business Fasia Industries to French strategic buyer Groupe Marck.

UK Watch: Smaller buyouts still growing

The UKтs smaller buyout space has gone from strength-to-strength in the second quarter of 2012, according to figures in the latest unquoteт UK Watch, in association with Corbett Keeling.

Oaktree Capital buys Integrated Subsea Services

Oaktree Capital Management has acquired a 62.5% stake in Integrated Subsea Services (ISS), according to reports.

HPE Holland backs Cotesa with €20m

HPE Holland Private Equity has invested €20m in German fibre-reinforced composites manufacturer Cotesa.

RiverRock closes European SME fund on €169m

RiverRock European Capital Partners has announced the final close of its European Opportunities Fund on тЌ169m.

Capvis and Partners Group sell Bartec to Charterhouse

Capvis Equity Partners and Partners Group have sold their majority stake in German industrial safety technology provider Bartec to Charterhouse Capital Partners.

Castle PE shareholder battle intensifies

Castle Private Equity’s battle with its shareholders has intensified after activist investor Abrams Capital became its largest investor.

Investcorp buys 30% of Turkish retailer Orka Group

Investcorp has taken a 30% stake in Orka Group, a Turkish retailer of high-end menswear.

Edge backs Working Partners and Beast Quest buyouts

Edge Performance VCT has supported the two companies acquiring UK-based publishing businesses Working Partners and Beast Quest.

Seventure leads €2m round for Domain Therapeutics

Seventure Partners has led a €2m financing round for biopharmaceutical firm Domain Therapeutics, contributing half of the fresh capital.

Lyceum-backed Access Group bolts on Delta Software

Lyceum Capital portfolio company Access Group has acquired Delta Software for ТЃ5.4m.