CEE Unquote

Mid Europa buys Mlinar

GP is currently investing from Mid Europa V, which held a final close on €500m in December

Livonia Partners to launch new fund

New fund expects to raise in 12 months and will deploy equity tickets in the range of €10-20m

Rockaway Capital backs $6.9m series-B for Gjirafa

Fresh capital will be used by the firm to scale its current products across the region

Arx buys two Czech facades businesses

Newly created business will be rebranded as Fenestra and expects sales of €40m this year

Innova buys Drukarnia Embe Press

Deal is only the second PE-backed buyout completed in Poland in 2019 and the third in CEE

Afinum-backed Cotta acquires Steinpol

Cotta's most recent acquisition was Sarajevo-based furniture manufacturer Sinkro in September 2018

White Star invests $10m in Packhelp

Existing investors Speedinvest, ProFounders and Market One Capital also take part

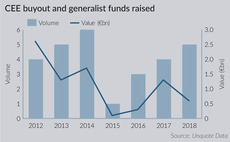

CEE fundraising activity promises buyout revival

Fundraising in the region held strong in 2018 in contrast to the rest of Europe and promises to be even stronger in 2019, even as dealflow slumped

Neveq targets €27m for third fund

Vehicle's predecessor Neveq II held a final close on €20.3m in 2014 and is now fully invested

Penta-backed Sensiblu buys Belladonna

Belladonna had 93 pharmacies prior to the trasnaction and the divested subsidiary includes 46

Genesis backs IT specialist CN Group

GP deploys capital from its Genesis Private Equity Fund III, which closed on €82m in September 2016

Karma Ventures to start raising new fund in 2020

VC's first fund, closed in Q2 last year, is approximately 25% deployed currently

Pollen Street increases offer for Prime Car Management

Firm initially offered PLN 20 per share on 20 February, but has increased this to PLN 23.25

Practica targets close on €40-50m in 2019

Practica Venture Capital II held a first close on €22m in December 2018, against a €40m target

Czech incubator launches €30m fund

New fund has been set up to invest at the series-A stage in B2B technology companies across Europe

Syntaxis sells Polflam to Baltisse

Firm's founders Maciej Szamborski and Wojciech Wilczak also make an exit in the sale

Innova Capital sells Neomedic in €70.5m deal

Sale of obstetrics-focused hospital group brings to an end a seven-year holding period

Mid Europa sells Bambi to Coca Cola for €260m

Mid Europa makes the divestment from Mid Europa IV, which closed on €880m in 2014

INVL holds first close on €106m for Baltic Fund

Closing took place on 7 February 2019, seven months after the vehicle was registered in June

Skolkovo leads $4m round for Roistat

Skolkovo manages three VC funds (Industrial Fund, IT Fund and Agrotech Fund) with RUB 5bn in AUM

Mid Europa-backed Hortex buys Jurajska

Bolt-on comes just over a year after Mid Europa’s secondary buyout of Hortex from Argan

Horizon hits $200m cap for third Ukraine fund

Vehicle was launched in June 2016 with a target of $150m and has already completed six investments

Revo launches second fund

Revo is understood to have secured approximately 35% of the targeted commitments

Genesis targets close and launch in 2019

Growth fund will focus on companies with revenues of up to €15m and EBITDA of up to €2m