Unquote

General Atlantic flagship fund GA 2021 closes on USD 7.8bn

Sixth flagship growth equity fund is more than twice the size of its USD 3.3bn predecessor

StepStone holds USD 690m final close for STGF III

STGF III will make fund, secondary and co-investments, focusing on technology and healthcare

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

Riverside hires Cole as fundraising and IR head

Allison Cole was previously head of fundraising and investor relations at Lightyear Capital

StepStone announces leadership transition

Scott Hart becomes sole CEO, while Monte Brem is to be named executive chairman

Unquote Private Equity Podcast: Leisure sector cleared for take-off

Unquote looks back at how the sector has fared, and speaks with PAI partner GaУЋlle d'Engremont following the ECG deal

GHO appoints new director of sustainable investing

GHO creates the new role in order to further institutionalise its commitment to ESG

Nauta closes fifth fund on EUR 190m

Fund was launched in December 2019 and went on to hold a first close in July 2020 on EUR 120m

Consumer dealflow rebounds strongly in Q3

More on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows

Vast majority of LPs plan to increase impact allocations – survey

HarbourVest's 2021 ESG, Sustainability, and Impact Investing Survey collated responses from 130 LPs

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

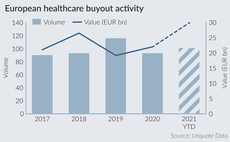

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

ECSO on lookout for LPs for EUR 1bn cybersecurity platform

ECSO aims to raise EUR 1bn by the third quarter of 2022, with the platform structured as a fund-of-funds

Carlyle gears up for next Europe Technology Partners fund

GP registers several Carlyle Europe Technology Partners V vehicles, with the most recent fund having closed in 2018

3i scores 47% IRR on Magnitude sale

Sale to US trade player Insightsoftware generates proceeds of USD 477m

Agilitas makes four new hires

Amol Judge, Nadja Goldbach, Niklas Quadt and Verdeep Dost join the investment team

Will private equity bank on rising interest rates?

Sponsors want in on banking businesses before greater confidence in asset quality and interest-rate hikes increase valuations

Podcast: In conversation with... Sunaina Sinha, Raymond James | Cebile

The Cebile Capital founder discusses the tie-up with Raymond James, and the key trends at play in the global fundraising and secondaries landscapes

White Star holds USD 360m final close for Fund III

Growth technology VC held a final close for its predecessor vehicle in 2018 on USD 180m

Leveraged loans issuance sets new record

High-yield bonds backing LBOs followed a different route, with volume decreasing 67% from Q2

Pantheon raises USD 624m for GP-led secondaries programme

Unquote recaps the fundraise and investment strategy with managing partner Paul Ward

2021 European PE exits already exceeding full 2020 tally

GPs are clearly looking to seize the initiative and clear out portfolios amid a general push to ink deals on the buy-side

Unquote Private Equity Podcast: Jersey doubles down on ESG

Unquote speaks with Elliot Refson to discuss how the jurisdiction is looking to better understand LP expectations and foster an ESG-focused ecosystem

Ace Capital raises EUR 175m for cybersecurity fund

Brienne III held a first close on EUR 80m in June 2019 and ultimately exceeded its target