Top story

Nordics investors remain active but cautious

H1 buyouts drop in the Nordic region after a busy 2017 as SBOs and trade sales take off

International appetite for Spanish deals soars in H1

Country's dealflow and aggregate value both reached record or near-record levels in H1, with international GP's fueling mid- and large-cap activity

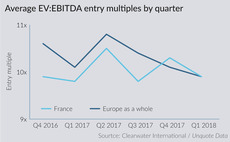

French mid-cap seeks new approaches as competition heats up

Buy-backs edge into the French mid-market, as H1 activity hits record highs and entry multiples swell

PE hot for insurance sector

Dealflow and aggregate value in the insurance sector has surpassed its post-crisis annual peak before the end of the third quarter of 2018

Fee structures: adventures in LP flexibility

As private equity continues to outperform other asset classes, some GPs are exploring new fee structures, with mixed results

LP Profile: Allianz Capital Partners

Co-head of PE Michael Lindauer speaks to Unquote about the firm's history and approach to investment

CEE dealflow drops in H1 as exits soar

Buyout activity in the first six months of 2018 was at the lowest H1 level seen since 2009

Cinven agrees to acquire ALE from Axa for €925m

Deal comes weeks after the GP transferred another life insurance business into its sixth fund

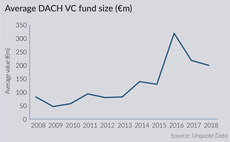

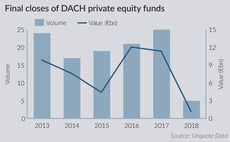

VC fundraising lifts off in DACH region

Six venture funds based in the DACH region have held final closes in 2018 for a combined €1.3bn

Q2 Barometer: European private equity hot streak continues

Average European PE deal value hit a post-crisis peak in Q2, while quarterly volume reached the highest level on record

DACH leads lower-mid-market fundraising

An overcrowded lower-mid-market in the Nordic region and the UK, coupled with Brexit, has boosted DACH fundraising activity

GP Profile: Lakestar

Unquote speaks to founder Hommels about the VC's future ambitions and the European venture landscape

Q&A: Alto Partners' Raffaele de Courten

Unquote speaks to the firm's founding partner about fundraising, dealflow and debt facilities in the Italian market

Reshaping the GP shareholding landscape

As the private equity market matures, shareholding structures of GPs are being reshaped, with a number of M&A transactions and minority stake sales

Allocate 2018: Risk-return for maiden managers and spin-outs

First-time vehicles have enjoyed historically good fundraising conditions over the last two years

British Private Equity Awards: final call to enter

Time is running out to enter the 2018 BPE Awards: entries are due by 4pm on Friday 13 July

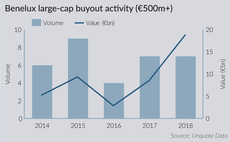

Benelux large-cap activity swells in H1

Aggregate value of deals valued at more than €500m is approaching pre-crisis levels, based on H1 2018 figures

Italian PE back in fashion

Despite a drop-off in 2017, total Italian PE value last year is still almost double that of the €4.1bn invested in 2012

Allocate 2018: ESG gains traction with European LPs

Numerous reports and studies have shown that LPs are increasingly concerned about their GPs' environmental, social and governance policies

Bolt-on activity flourishes in CEE region

As the region continues its convergence with the west, a decrease in perceived risk is paving the way for increasing buy-and-build activity

GP Profile: Gimv

Investor relations and corporate communications manager De Leenheer discusses the firm's history of public backing and current strategy

Italian funds find new source of capital

Local private pension funds are hiking their allocations to Italian private equity, improving fundraising prospects in the mid-market space

Unquote British Private Equity Awards: FAQs

Entering the 2018 British Private Equity Awards? Here are our FAQs to help your submission

DACH fundraising picks up steam after slow Q1

Funds holding final closes in Q2 have surpassed the total amount raised in the first quarter of the year, following a strong 2017