Top story

France Invest seeks to capitalise on Macron's reforms

Trade body's newly appointed chair discusses plans to capitalise on reforms and bolster the popularity of the PE ownership model

Q&A: Nordic Capital's Kristoffer Melinder

Partner Melinder discusses Nordic fundraising, the increasing focus on ESG, and differentiated strategies in high-price environments

Q1 entry multiples drop to lowest level since Q1 2016

PE deal valuations drop for the third consecutive quarter, as the Nordic region continues to see the highest entry multiples

GP Profile: Mangrove Capital

An early backer in Skype and Wix, Mangrove held a final close on €200m for its fifth fund earlier this year

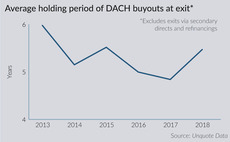

DACH investors turn to value creation to justify high multiples

Three of the five most active private equity firms based in the DACH region last year used non-standard investment models

Co-investment: Dancing to a new tune

Co-investment has evolved from a value-add into an industry staple, but debate remains as to whether the strategy favours LPs and GPs equally

VC fuels Europe's journey towards self-driving future

Despite the long-term nature of investing in autonomous vehicles and high barriers to entry, fund managers are finding routes into the segment

PE-backed UK IPOs outperform, but listings remain slow

Despite a strong track record, PE-backed listings have been few and far between in 2018, but signs of an increase in activity are emerging

LP Profile: Stonehage Fleming

Head of PE Clarke-Jervoise discusses the multi-family office's client base, investment strategy and recent approach to GP relationships

ESG bridges business and societal cultural gap in France

French GPs are widely adopting more proactive ESG practices in an effort to reflect the country's cultural mindset

Dutch VC activity reaches all-time high

Biotech and pharma are driving record levels of VC investment in the Netherlands, while venture fundraising continues to perform strongly

Payments sector heats up across the Nordic region

PayPal's $2.2bn acquisition of VC-backed iZettle highlights the Nordic region's leading position in the payments tech market

Italian PE enjoys vibrant Q1 despite political uncertainty

Buyout and exit activity in the country ballooned in the first quarter of 2018, despite the prolonged uncertainty surrounding the general election

LP Profile: Pantheon

Managing partner Ward talks to Unquote about the resurgence of separate managed accounts and shying away from first-time funds

Debt funds carve out niche in Polish lending market

Alternative credit providers are pursuing smaller, more complex transactions and are often willing to invest alongside traditional lenders

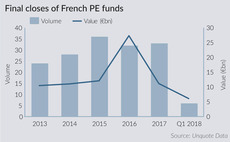

French fundraising on course for bumper year

Country has seen funds closing with a combined €6bn in commitments in Q1, more than half the total seen in 2017 as a whole

Alliance of equals: PE's evolving buy-and-build approach

Portfolio companies are increasingly making larger bolt-ons, as GPs look for new ways to boost returns in a market with high entry multiples

GP Profile: Baird Capital

Partners from the firm's three regional teams discuss Baird's new global approach to capital deployment and its future plans

Local GPs rule the roost in Turkish mid-market

International investors struggle to gain a foothold in the Turkish mid-market as local networks provide domestic firms with a headstart

LP Profile: Hamilton Lane

Firm's managing directors Strang and Lei Ortiz discuss the merits of smaller relationship pools and how ESG is at the heart of its activities

Q1 Barometer: Mega-deals propel value to post-crisis record

Deal volume reached the second highest quarterly level in two and a half years, while aggregate value climbed to тЌ54bn

Sino-French PE relations move forward

Chinese trade buyers, GPs and LPs are increasingly active in the French market as the number of funds with Sino-French strategies increases

Mid-market leverage continues upward creep

High price tags, limited assets and cheap debt are helping to push up leverage boundaries in the European mid-market once again

Dutch finance minister hails mature PE market

Wopke Hoekstra recently addressed parliament to endorse a social impact study by the University of Amsterdam, which was supportive of the impact of PE