United Kingdom

Bowmark sells LBR to Levine Leichtman

Secondary buyout of the legal publishing company brings to an end a five-year holding period

Foresight appoints Haywood as investment manager

New recruit previously co-founded biotech company Puridify, which was sold to GE Healthcare

Aurelius buys Connect Books

Division comprises six brands and has projected combined revenues of тЌ250m for 2017

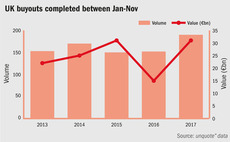

UK buyout activity reaches post-crisis peak in 2017

Small-cap and lower-mid-market invested strongly during the course of the year, while fundraising activity continued apace

BGF, Blue Water Energy inject £56m into Rovop

Subsea vehicle services company will expand its fleet by 50% following the transaction

AnaCap sells First Names to Astorg's SGG

Transaction sees AnaCap generate a 2.6x money multiple on its investment in the administration business

BGF invests in APS Group

Tomato producer will invest in a new glasshouse, site expansion and automation technology

Ontario Teachers' partially divests Busy Bees to Temasek

Nursery school business has undertaken an acquisitive growth strategy under the LP's tenure

Global Founders leads $14.75m series-A for DigitalGenius

Fresh funding will enable the company to invest in product development and marketing activity

Atami Capital leads £40m series-B for Simba Sleep

Saracens chair Nigel Wray also takes part in the round alongside Wharton Asset Management

Apera Capital backs refinancing of LDC's Seabrook

LDC mandates Apera to provide facilities worth ТЃ23.5m to support Seabrook's growth

Rise of the UK's private markets

Average values of British PE buyouts have soared over the last 20 years, as increasingly fewer businesses are trading on the London stock exchange

Perwyn-backed Sumo floats with £145m market cap

Listing of the video games developer will generate ТЃ39.7m returns for Perwyn and company management

Maven appoints directors for MEIF Debt Fund teams

Steve Lewis and Jonathan Lowe join Maven in Birmingham and Nottingham, respectively

August Equity acquires dental practices for £5.75m

Second acquisition in the strategy after the GP acquired Genesis Dental Care in May

Terra Firma's Four Seasons agrees interest payment standstill

Major creditor H/2 has agreed to the measure in order to facilitate a consensual restructuring

Rubicon, Grovepoint's Goodridge bolts on Gieffe Racing

Rubicon provided fresh capital to support the acquisition of the automotive fluids business

Eight Road leads $20m round for OTA Insight

Hospitality-focused data analytics company will invest in product development and make new hires

Phoenix sells Riviera to Silverfleet

Sale of holiday provider brings to an end a three-year holding period for the vendor

Riverside invests in LeftShift

Investment in the delivery automation business was made via the GP's acceleration capital division

Shard holds first close on £90m for private debt fund

Fund targeting ТЃ250m with ТЃ300m hard-cap, expects to hold a final close by the end of 2018

PE-backed Mirriad to list in £63.2m IPO

Company raised ТЃ26.2m in gross proceeds through a conditional placing of shares

Crescent-, Viridian-backed Fusion Antibodies to list on AIM

Northern Irish biotech company will use the capital to invest in its laboratories and manufacturing

Mercia invests £2.5m in Medherant

Investment is part of a ТЃ3.8m funding round from other private investors and existing shareholders