Unquote Data

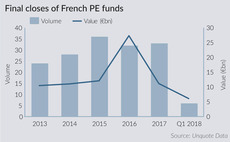

French fundraising on course for bumper year

Country has seen funds closing with a combined €6bn in commitments in Q1, more than half the total seen in 2017 as a whole

France Fundraising Report 2018

The first quarter of 2018 has set the tone for what is likely to be a busy year for fundraising in the region

PE activity flourishes in Portugal as economy picks up

Companies with strong export focuses and internationalisation strategies are attracting investment from institutional fund managers

UK and Ireland small-cap soars amid general buyout lag

Overall UK buyout activity in Q1 is down by almost a third year-on-year, though dealflow in the small-cap space remains near record levels

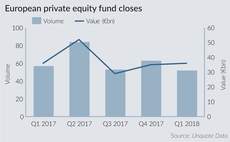

European fundraises off to healthy start in 2018

Number of fund closes and aggregate capital raised in Q1 is roughly on par with the same period last year, but short of the strong start to 2016

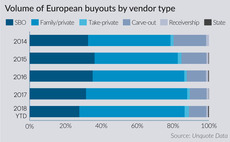

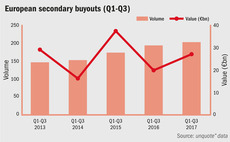

Secondary buyouts hit 10-year low in Q1

Proportion of deals sourced from fellow PE firms has ebbed back to the level last seen in 2007, according to Unquote Data

European entry multiples hit new high in 2017 despite Q4 cooldown

Average EBITDA multiple increased to 10.4x in 2017 compared with 10.2x in 2016, according to the latest Clearwater Multiples Heatmap

Annual Buyout Review: Lower-mid-market momentum lifts dealflow

Unquote's lastest Annual Buyout Review is now available to download for subscribers, offering in-depth statistical analysis of 2017 activity

Large-cap deals drive strong start to 2018 for European PE

GPs deploy an extra тЌ7bn in aggregate value across European buyouts in the first two months of the year compared to 2017

European PE in 2017: Scaling new heights

Buyout activity and fundraising reached a new peak in 2017, with mega-buyouts and small-cap deals fueling dealflow and French funds popular among LPs

DACH auto-parts deals motor on as sector transforms

Private equity players remain keen on auto-parts, as the sub-sector responds to rapid changes brought about by the electrical vehicle market

CEE Fundraising Report 2017

An in-depth statistical analysis of recent fundraising trends in CEE, with insight from local experts, now available to download

Fundraising record rounds off active year for Nordic region

Region saw strong fundraising and high deal volume off the back of low interest rates in 2017

Unquote's 2017 digest

unquote" looks back on an impressive 2017, which saw increases in the volume and aggregate value of buyouts and a buoyant fundraising environment

Benelux funds specialise to compete with strategic buyers

Record level of commitments were secured by Benelux funds during 2017, with GPs increasingly turning to sector specialisation

Spanish private equity flourishes as Italian market cools

Southern Europe's leading PE markets responded drastically differently to the challenges of a turbulent 2017

UK & Ireland Fundraising Report 2017

Proprietary statistics on the local fundraising market and insights from leading practitioners and LPs

European SBOs reach record levels in first three quarters

Europe sees 202 secondary buyout deals between January and September, surpassing the peak of 200 seen in Q1-Q3 2007

Tech deals return to the CEE region

Tech activity in CEE remains sluggish, though aggregate values are on the increase

Unquote launches new global private equity event

Allocate will bring together prominent LPs and GPs to discuss the next private equity cycle

Benelux open for business as trade sales recover

Nine months into 2017, the number of exits to trade buyers exceeds 2016's levels, reflecting healthy European corporate M&A activity

DACH Fundraising Report 2017

Private equity fundraising in the DACH region, as in the rest of Europe, is seeing continued strength

H1 fundraising reaches second-highest level on record

Last three semesters represent a significant increase on the total sums raised for final closes, compared with historical levels

International backers fuel record-breaking H1 in Spain

Country's dealflow has reached the highest level in value terms ever recorded