Unquote Data

Onex raises $5.72bn for fifth fund after four months

Canadian-based GP is targeting $6.5bn for the vehicle, which launched in April 2017

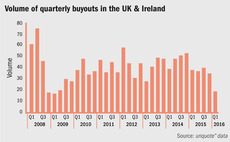

UK PE activity rebounds in H1 despite political turmoil

British buyout market witnessed a significant year-on-year increase in activity in the first half of 2017, despite political uncertainty

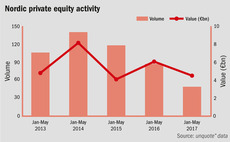

Nordic fundraising market remains buoyant despite dealflow dip

In the first part of our 2017 Nordic Fundraising Report, unquote" examines statistics for the local market across 2013-2017

Spain reaps highest value in Q1 since 2005

Spanish private equity firms deployed the highest volume of capital in 12 years during Q1 2017, with €4.7bn deployed

Strong start in CEE for second year running

Region registered 10 deals in Q1 for the second year running, though 2016 saw deal volume halve in H2

Nordic buyout market off to slow start in 2017

Buyout volume in Q1 was slowest start to a year since 2013, while Q1 exit figures were at their lowest first-quarter level since 2011

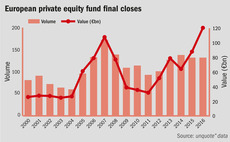

European fundraising surpasses pre-crisis high

Funds investing in Europe raised €120bn in 2016, up 37% on the year before

Portugal boosts southern Europe's 2016 resurgence

Recent uptick in the country's buyout activity mirrors similar investor appetite seen five years earlier in Spain

UK consumer deals slump as GPs heed Brexit warnings

Strong consumer spending figures in the months following the EU referendum have not translated to increased PE investment in the sector

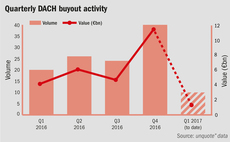

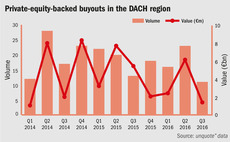

Quiet start to 2017 for DACH buyouts following Q4 flurry

Number of large German deals saw the DACH region outpace its European neighbours at the end of 2016, in terms of aggregate value

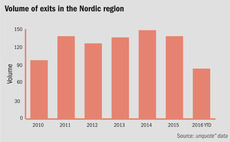

Nordic exits facing slump in 2016

Market needs strong fourth quarter numbers to surpass last yearтs exit volume and avoid a five-year low

In Profile: LPs

Our series of in-depth strategy updates and data-driven activity analysis of the major players invested in European mid-market PE funds

DACH buyout dealflow hits 15-month high in Q2

Buyout volume and aggregate value were up by 43% and 155%, respectively

Europe's top five summer buyouts

unquote" lists the five largest buyouts to have taken place so far this summer across Europe

UK exits down 30% in H1 2016

Exits from buyout investments were down across the board in H1 2016, especially IPOs and trade sales

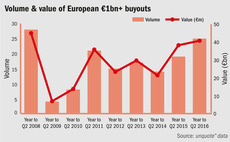

Southern Europe leads renaissance of billion-euro club

Dealflow in the тЌ1bn+ buyout segment reached an eight-year high across Europe in the 12 months to Q2 2016

UK buyout activity continues apace despite Brexit vote

Activity figures for July would suggest that local private equity houses have not been deterred т with a few caveats

Denmark increases share of Nordic PE deals

Southernmost Scandinavian country was the busiest country by deal volume in 2015

Berlin keeps Germany afloat

The German capital has emerged as the lone bright spot in the country, buoying the German private equity industry

Benelux: alternative lenders to the rescue

With Benelux deals on the wane, could more flexible financing methods unclog the region's private equity market?

CEE exit pace rebounds on strong macro

So far in 2016, unquote” data has recorded the highest volume of exits in H1 since 2013

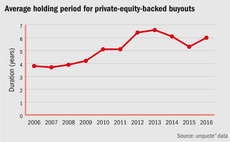

Holding periods lengthening again following 2015 drop

Holding periods for assets exited in so far 2016 have climbed following a drop in 2015, but still sit lower than the 2012-2014 average

UK buyout activity suffers deepest decline since 2009

The volume of buyouts witnessed so far for the first quarter of 2016 is the lowest on record since 2009

Value of European buyouts rose by almost 35% in 2015

Leading with an impressive hike in aggregate value, discover the key findings of our Annual Buyout Review