Unquote Data

Average UK buyout value up 24% year-on-year

Q1 2015 average value down on Q4 2014 spike, however

Season's greetings from the unquote" team

Looking forward to seeing you in the New Year

unquote" rolls out new mobile site

New version greatly enhances ease of use on mobile, tablets

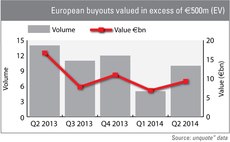

Large-cap activity gaining momentum in Q2

Welcome uptick at larger end of market, both for new deals and exits

European private equity activity drops to 2005 lows

Findings from the latest unquote” Private Equity Barometer, published in association with SL Capital Partners, reveal a worrying drop in deal volumes, falling to the same level as Q4 2005.

Fundraising: Germany's drawing power

The number of funds raised by German players – and the amount of capital they have been able to draw in – has increased steadily in the post-crash years.

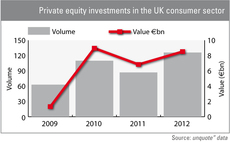

UK consumer sector: private equity dealflow up 45% in 2012

High street woes notwithstanding, the UK consumer sector proved to be ripe for investment opportunities last year: private equity dealflow was up by 45% compared to 2011 figures while the overall value of these investments rose by a quarter.

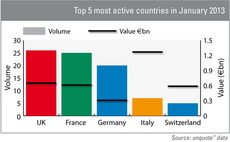

Italy shines in January thanks to CVC mega-buyout

Italy topped Europe's private equity value charts in January, while the UK recorded the most deals, showing both familiar names and outliers starting 2013 on a high.

Capital cities attract most private equity investments

Europe’s capital cities attract the lion's share of private equity investment, though other regions in Europe have been shown to be very active, according to new research from unquote” data.

Early-stage deals bounce back in Q4

After a slow summer, early-stage investments took off in Q4, according to the latest unquote” Private Equity Barometer, published in association with Arle Capital Partners.

Growth equity deals enjoy Q4 uptick

Growth capital investment activity recovered substantially in Q4 following a poor third quarter, but remains low compared to recent historical averages.

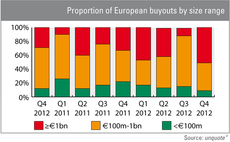

Mega-buyouts bolster Q4 activity figures

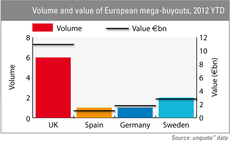

The €11.6bn overall enterprise value of Q4’s large-cap deals is the largest total since the third quarter of 2010, which itself was by some margin ahead of every quarter since Q3 2007 (see chart).

Retail sector activity benefits from economic woes

The current economy has forced most retail businesses to rethink their strategy, leaving enough space for private equity firms to come in and get their share.

Germany quiets down in Q4

After a substantial increase in deal activity in Q3, the German private equity market grew quieter again towards the end of 2012.

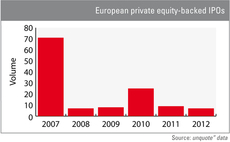

PE-backed IPOs few and far between in 2012

Moleskine might make headlines if and when it finally lists on the stock market later this year, but flotations remained a seldom-explored exit route for GPs in 2012, continuing a trend initiated in 2008.

Cinemas could be the big deal in 2013

While Terra Firma is considering getting out of the movie business, its private equity competitors could see some very attractive investment opportunities this year.

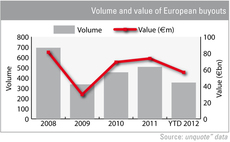

European buyout dealflow falls 30% year-on-year

Despite a strong showing by the UK market, European buyout activity fell by almost a third volume-wise in 2012, according to unquote” data.

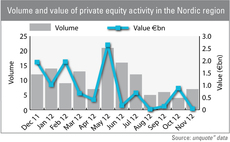

Frozen Nordic market

In just two years, Sweden has lost half of its deal volume, showing that even the popular Nordics are not immune from Europe's economic drag.

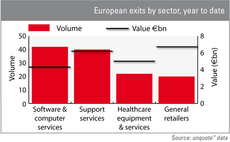

Software and retail lead 2012 exit league

General retailers and software & computer services lead the exit rankings for 2012.

French deal volume at 14-year low

French investment volumes in 2012 are set to be the lowest seen in the country for over a decade, according to the latest figures from unquote” data.

UK mega-buyouts worth more than €10bn this year

In defiance of problems on the continent, the UK has seen a surge in mega-buyouts this year, topped off with the recent acquisition of Annington Homes for ТЃ3.2bn.

Volume of exits increases in October

After a slow September, exits picked up again last month, but overall volume seems lower as the year comes to an end.

The pitfalls of turnaround investing

Turnarounds are in the news once again, with the decision by specialist investor OpCapita to put struggling electricals retailer Comet into administration. Last week, Deloitte took over the administration of the business, and on Monday made over 300 staff...

Sweden continues to lead Nordics

Sweden outpaced its Scandinavian neighbours in the 12 months leading up to November. A SVCA study shows that industry optimism returned just in time for year-end.