Articles by Greg Gille

Livingbridge hires Osman and Manning

Rebecca Osman and Nick Manning join as investment director and investment manager respectively

Q3 Barometer: deal volume hits new record with mid-market push

Buyout market has been strengthening consistently and was only four deals away from hitting 300 in the third quarter

Nordic Capital aiming for further Munters sell-down

Nordic Capital already made a partial sell-down earlier in the year, selling 25 million shares at SEK 44 apiece

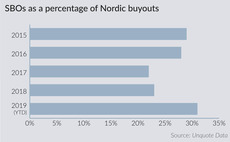

"Pass-the-parcel" deals surge in Nordic region as PE matures

At nearly a third of all buyouts, the proportion of SBOs is now higher in the Nordic region than it is across Europe as a whole

CEE fund closes make headlines as dealflow slows

PE and VC activity has been rather sedate across the CEE region in October, with interim fund closes instead animating the market

KKA Partners back on road for Fund II

Firm was founded by Dominic Faber and fellow partner Kaspar Hartmann in 2018

Altor, TDR secure stakes in Thomas Cook Northern Europe

Acquisition will safeguard the jobs of 2,300 people working for the profitable division

Argo Capital targets year-end first close

Argo is targeting a €40m first close for the firm's inaugural energy transition fund

Unquote Private Equity Podcast: Co-op mode

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team talks all things co-investment

LauncHub Ventures raising new €70m fund

New fund has €25m committed to date and hopes to close in Q1 or Q2 next year

Verdane buys CAP-Group

All the entrepreneur shareholders will stay on as minority owners in the business

Tikehau offloads Eurazeo shares

Tikehau will retain a 5.1% stake in listed French PE investor Eurazeo following the transaction

EU investment firm prudential regime: what managers should know

Unquote sister publication Private Equity Law Report hosts a guest article by two Sidley Austin lawyers

Santander InnoVentures et al. back €35m CrossLend series-B

Round also includes funding from existing investors Lakestar, ABN Amro Ventures and Earlybird

Gyrus Capital bolsters team ahead of imminent fundraise

Outfit was launched in late 2018 by two former Altaris and Argos Wityu executives

Listed Private Capital Report 2019

Listed PE is yet to see the boom that listed infrastructure has in recent years, but several trends suggest the gap may shrink

YFM invests £4.5m in SharpCloud

YFM invests via its VCTs as well as YFM Equity Partners Growth II

Synova inks first deal from latest fund with Preventx

Preventx is a provider of online-led sexual health testing and diagnostic services

Ahren et al. in $16m round for Mogrify

Biotech's series-A is supported by a consortium of investors led by existing backer Ahren

Unquote Private Equity Podcast: Calling in the specialists

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses specialist and venture fundraising

Q&A: 3i’s Olinick and Bakker on managing the tech/services convergence

Andrew Olinick, partner and co-head of 3i's North America business, and Netherlands-based director Mark Bakker talk tech and services

British Private Equity Awards 2019: winners announced

Congratulations to the winners of the hotly contested 2019 British Private Equity Awards, announced last night in London

EQT Credit moves in to take over Charterhouse's Bartec

EQT Credit II and EQT Credit Opportunities III have notified the Austrian regulator

Everledger secures $20m series-A

Backers include Tencent Holdings, Graphene Ventures, Bloomberg Beta, Vickers Venture Partners and others