Deals

Canaan leads $12m round for onefinestay

Canaan Partners has led a $12m series-B funding round for London-based accommodation manager onefinestay.

Industrifonden leads €11m round in Nuevolution

Industrifonden and existing investors have provided Danish biotech company Nuevolution with a DKK 80.5m (тЌ11m) round of funding.

Intel leads €20m round in FlatFrog

Intel Capital has led a тЌ20m funding round in Swedish touch screen pioneer FlatFrog Laboratories backed by existing investors Invus and Sunstone Capital.

Doughty raises $1.1bn from Norit sale

Doughty Hanson has sold activated carbon specialist Norit to US trade player Cabot Corporation for $1.1bn.

Intel Capital et al. back KupiVIP

Intel Capital has led a $38m funding round for Russian e-commerce fashion retailer KupiVIP Holding.

Vector wins Technicolor battle

US private equity house Vector Capital has seen its offer for a minority stake in troubled French digital video specialist Technicolor accepted by the company's shareholder - pipping JP Morgan to the post.

FSI Régions backs Raynier Marchetti

FSI Régions has invested €1m in French corporate catering company Raynier Marchetti.

Eden Ventures et al. exit WE7 to Tesco

Eden Ventures has sold its minority stake in Peter Gabrielтs digital music platform WE7 to retailer Tesco.

Climate Change Capital et al. in €12m PPC series-B

Climate Change Capital (CCC) has invested alongside strategic investors Siemens Financial Services Venture Capital and British Gas in a €12m series-B round for German smart grid company Power Plus Communications (PPC).

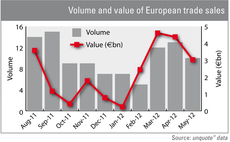

Trade sales on the rise

The partial sale of Alliance Boots to Walgreens by KKR and AXA PE is the latest in a series of exits propping up trade sale figures in 2012. Meanwhile the secondary buyouts trend is showing signs of abating. Greg Gille reports

Bridgepoint's LGC receives additional £80m from lenders

Forensics and scientific testing company LGC, owned by Bridgepoint, has raised ТЃ80m of additional capital from a consortium of lenders.

Antares backs Chili

Antares Private Equity has bought a 15.4% stake in Italian film streaming platform Chili.

Alliance Boots partial exit raises £4.3bn cash and shares

KKR and AXA Private Equity have made a partial exit from Alliance Boots following a cash and shares offer from US pharmaceutical retailer Walgreens.

VCs in $28m funding round for Oxford Immunotec

A pool of venture capital firms has backed a $28m funding round for Oxford Universityтs medical diagnostics spin-off Oxford Immunotec.

BGF invests £4.4m in Springfield Healthcare Group

Business Growth Fund (BGF) has injected a total of ТЃ4.4m into care provider Springfield Healthcare Group.

Permira-backed Telepizza extends loans

Permira has led a €35m equity injection into Spanish fast food chain Telepizza as part of a larger refinancing operation, according to reports.

Evonik cancels IPO

CVC-backed German chemicals maker Evonik has announced the cancellation of its planned IPO.

Pentech backs Nutmeg with £3.4m

Pentech Ventures has joined a ТЃ3.4m funding round for online investment manager Nutmeg.

Europe-wide PE investment to fall below €45bn in 2012

Following a lacklustre start to 2012, Europe should see year-end buyout investment levels barely hit the €40bn mark – the first glitch in an otherwise steady recovery since 2010. Greg Gille reports

FSI Régions leads round for Callejo Transports

FSI Régions has invested €1.5m in night transportation company Callejo Transports.

FSI Régions backs Coprométal

FSI Régions has injected €1m into French packaging producer Coprométal in exchange for a minority stake.

FSI Régions backs Abzac

FSI Régions has injected €2m into French cardboard tubes and core provider Abzac in exchange for a minority stake.

Newfund invests €1m in Sykio

French VC Newfund has provided software developer Sykio with €1m of growth capital funding.

EdRCP takes majority stake in EuroTechnoCom

Edmond de Rothschild Capital Partners (EdRCP) has acquired a majority stake in French telecoms maintenance equipment company EuroTechnoCom (ETC).