Industry

Average fund size reaches new heights amid stark market bifurcation

Average buyout fund close for 2021 stands at EUR 1.33bn, more than double the EUR 629m recorded in 2017

FSN Capital appoints new co-managing partners

First succession transition for the Nordic firm since it was founded in 1999

Golding hires Schütz as ESG director

Christian Schütz joins from his role as senior vice-president of credit research at Pimco

Multiples Heatmap: TMT deals inked in Q3 pass 19x mark

Average entry multiples were again pushed into record territory in Q3 on the back of a still-buoyant M&A market

Waterland opens Spanish office

GP has hired David Torralba as principal and head of Spain, plus Guillermo Galmés as senior advisor

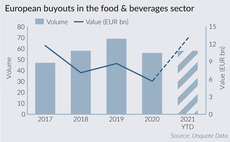

Food and beverage buyouts to reach EUR 13bn in 2021

An average of 44 buyouts totaling EUR 5.1bn were completed in the sector from 2011-2020

Bain gears up for sixth European buyout fund

US-headquartered GP held a final close for its previous European fund in 2018 on EUR 4.35bn

ICG to exit Park Holidays in GBP 900m trade sale – report

ICG acquired the caravan holiday park operator in a GBP 362m SBO from Caledonia Investments in 2016

GP Profile: Adelis steps up deal-making after latest fund close

Co-managing partner Jan У kesson and head of IR AdalbjУЖrn Stefansson speak to Unquote about the Nordic mid-market-focused GP's fundraise and deployment plans

GP Profile: Baird positive on UK dealflow despite valuation inflation

Baird Capital has so far exited three businesses from its first fund, taking advantage of what it sees is a strong M&A market

PE funds rework packaging investments around ESG concerns

Can private equity's decades-long love affair with the packaging industry last?

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

Riverside hires Cole as fundraising and IR head

Allison Cole was previously head of fundraising and investor relations at Lightyear Capital

EQT acquires LSP, forming EQT Life Sciences

Announcement follows Life Sciences Partners' seven-month, EUR 850m fundraise for LSP VII

Proventis hires Jan Wetter as M&A partner

Wetter was previously an M&A partner and office managing partner at EY in Zürich

StepStone announces leadership transition

Scott Hart becomes sole CEO, while Monte Brem is to be named executive chairman

Investindustrial sets SBTs for emissions

GP has also committed to achieving net zero greenhouse gas emissions in its funds

YFM appoints Marcus Karia as CFO

Karia was most recently group finance director of London-listed venture capital firm Arix Bioscience

Unquote Private Equity Podcast: Leisure sector cleared for take-off

Unquote looks back at how the sector has fared, and speaks with PAI partner GaУЋlle d'Engremont following the ECG deal

Eurazeo grew AUM by 44% over past 12 months

Asset manager raised EUR 3bn from limited partners in the first nine months of 2021

Activa Capital hires associate in investment team

Prior to joining, Julie Perouzel worked as an M&A analyst at Rothschild & Co for a year

Perwyn appoints investment manager from Omers

Maxime Menu joins from Omers Private Equity, where he worked as a senior associate

Victus to come back to market in early 2022

Vehicle will pursue the same strategy as its predecessor, targeting mature agriculture- and food-related businesses

M&A insurance demand reaches new heights amid bottleneck concerns

Hardening W&I market could be adding to the current slowdown in M&A activity that has followed a flurry of deals earlier in the year