Performance

Healthcare investments wane after strong Q2

Investment in the healthcare industry is facing tough times as total deal value falls to its lowest level in 18 months.

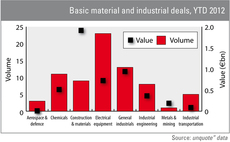

Ahlsell deal boosts construction sector value total

The construction & materials sector has seen €1.9bn worth of private equity deals being completed since January, exceeding the overall amounts invested in other industrial sub-sectors.

HarbourVest NAV registers slight drop in July

HarbourVest Global Private Equity has announced an estimated net asset value (NAV) of $935.4m at 31 July 2012.

PE-backed SMEs show increased employee numbers

Staff count at PE-backed companies has increased by an average of 26% since 2000, recent research by asset manager Adveq shows.

Mid-market leads value creation

Mid-market leads value creation

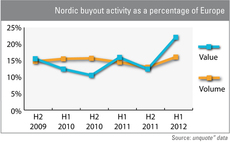

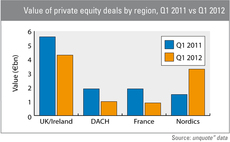

Nordics' role in European PE strengthens in H2 2011

The Nordics saw a strong first half of 2012, driven by a few large deals, pushing aggregate value from €3.4bn in H2 2011 to €5bn, showing the region's resilience to the eurozone crisis and its economic strength.

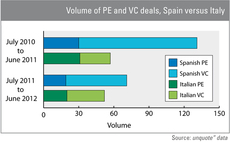

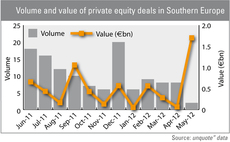

Spain continues to outperform Italy in deal volume

Despite the country's dire economic state, Spanish private equity activity has continued to outpace that of Italy continuously over the past 24 months - although the latter showed more resilience last year.

CalPERS PE portfolio performance in sharp YoY drop

The California Public Employees’ Retirement System (CalPERS) has announced a 5.3% return for its private equity portfolio in the fiscal year 2011/12, down from 25.3% in 2010/11.

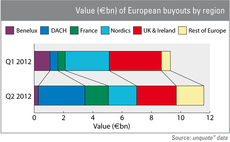

DACH buyout market outweighs neighbours in Q2

Buyouts in the German-speaking region have shown a significant gain in value from the first to the second quarter of 2012, enabling the region to top the regional aggregate value table.

UK support services boom in Q1 2012

The support services sector performed well in Q1 of 2012, raising expectations of strong growth for the remainder of the year.

Secondary buyouts continue to boom, but for how long?

The European secondary buyout market is deeper and more active than the primary market, but buyers should beware that its health is ultimately dependent on the same factors that drive primary transactions. Anneken Tappe reports

UK and Nordics outperforming rest of Europe

Research from unquote” data finds that the UK/Ireland has not only outperformed its continental European counterparts in Q1 of 2012, but it was also the only region to raise deal volume levels above those of 2011.

Southern Europe: Volume drops, value soars

Deal activity remained particularly subdued across Southern Europe in May, although the Rottapharm buyout in Italy sent overall value soaring.

Netherlands: Out of sight for foreign GPs?

The latest market report from the Dutch private equity association (NVP) shows that GPs in the Netherlands have strengthened their position between 2010 to 2011. However further research by unquote" data reveals that the participation of international...

French LBOs top European performance tables, says AFIC

LBOs generated higher returns in France than in all other European countries in 2011, although their performance declined year-on-year, according to a recent study by private equity association AFIC.

European assets remain attractive despite euro crisis

Despite worries about Greece, Spain and Italy, US investors have demonstrated a continued appetite for European assets. Europe still remains a tough market for the moment and funds will have to play their cards right to maintain the interest of big American...

Portfolio companies optimistic on 2012

Portfolio companies have an increasingly positive outlook for the future despite ongoing concerns regarding the economy, according to a PricewaterhouseCoopers survey.

Exit volumes surge despite tough conditions

unquote” data shows that exit volumes surged in 2011 as private equity houses sought to satisfy investor demands, but it is uncertain if this trend will continue in 2012. Anneken Tappe reports.

PE performance: UK outclassed neighbours in Q3, says study

Cambridge Associates finds that the UK private equity and venture capital markets outperformed other developed economies (excluding the US) in an otherwise negative Q3 2011.

Investments by regional funds

The volume of investments backed by regional initiatives has followed the general market curve of recent years: after the boom year of 2007, they plunged.

Corporate divestments decline across Europe

As industry players remain cautious with regards to dealflow, unquote” data shows that the trend in domestic corporate divestments is heading downhill. Anneken Tappe reports

Early-stage deal rate highest in Europe

A look at early-stage activity in 2011 across Europe shows the DACH region is consistently the strongest player in the early-stage market, followed by the UK & Ireland.

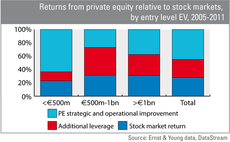

Leverage drives up prices, not returns

PE pays more for assets than trade, with the debt lining vendorsт coffers rather than enhancing buyersт returns, according to a recent study. Kimberly Romaine reports.

unquote" Private Equity Barometer – Q2 2011

Preliminary figures released today in the Q2 2011 unquote" Private Equity Barometer reveal renewed activity during Q2.