DACH

DBAG buys BTV

DBAG draws equity for the transaction from the new vintage of its growth capital fund, DBAG ECF II

3i promotes Crane to partner amid appointments wave

GP hires Rothschild's Howard as director and makes four further senior European PE promotions

HTGF sells Sierra Sensors to trade

Sale ends a 12-year holding period for HTGF, which invested in the business from its first fund

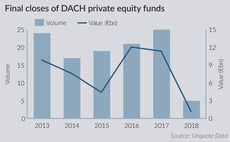

DACH Fundraising Report 2018

Private equity fundraising in the DACH region continued to build on strong momentum in 2017

EQT Ventures leads $18m series-B for Silexica

Existing investors Merus Capital and Pau Ventures also take part in the round

DACH fundraising picks up steam after slow Q1

Funds holding final closes in Q2 have surpassed the total amount raised in the first quarter of the year, following a strong 2017

Insight backs $18.8m series-C for Blinkist

Existing investors Greycroft, IBB Beteiligungsgesellschaft and EVentures also take part

DLA Piper hires Baker McKenzie's Schumann

Schumann will be responsible for advising private equity and corporate clients on M&A transactions

Golding hires Allianz director Sedlmayr

Sedlmayr will be responsible for institutional client services and sales

ECM holds final close on €325m hard-cap

Fifth buyout fund attracts commitments from 20 LPs from Europe, North America and Asia

Alpina sells Dolan to Dralon

Sale ends a holding period of three years for Alpina, which bought the firm in a double acquisition

Nauta leads €6m series-A for Talentry

Existing shareholder Global Founders Capital also took part in the funding round

BWK-backed IT-Informatik buys Mercoline

Mercoline previously operated as a subsidiary of office supplies business Pelikan Group

Beringea leads €10m series-B for MYCS

Deal is Beringea's first investment in Germany and its second in the DACH region

Q1 entry multiples drop to lowest level since Q1 2016

PE deal valuations drop for the third consecutive quarter, as the Nordic region continues to see the highest entry multiples

BWK buys H&R Industrierohrbau

Co-founders Alexander Hock and Andreas Rohleder will both retain a stake in the new company

PE-backed Wemas acquires Gerding

Previous owner Thomas Gerding acquires shares in Wemas in the transaction

Bain's Fintyre bolts on Reifen Krieg

Deal is the second acquisition made by Fintyre in Germany, following the bolt-on of Reiff Tyre

ICG sells Nora Systems to trade for $420m

Sale ends a holding period of five years for ICG, which first entered as a minority shareholder

VC-backed Home24 prices €600m IPO

Flotation prices at the higher end of the €19.5-24.5 range set at the start of June

Invision sells Swiss Education Group to Summer Capital

Deal ends a 10-year holding period for Invision, which acquired the business in 2008

Avedon sells Seebach to trade for €60m

Avedon acquired the business in 2012, drawing equity from the €190m NIBC Growth Capital Fund II

Advent buys Deutsche Fachpflege from Chequers

Current management team will retain a stake in the new company and remain in their positions

Invision launches sixth buyout fund

Fund was registered in Jersey on 5 December 2017 as Invision VI Limited Partnership