France

Bridgepoint Development Capital IV hits £1.5bn hard-cap

Fund exceeds its ТЃ1bn target after around eight months on the road, Unquote understands

Oaktree Capital buys Stade Malherbe Caen

GP invests in the company alongside French entrepreneur Pierre-Antoine Capton, who is appointed as chair

Ambienta opens Paris office, hires two new partners

Gwenaelle Le Ho Daguzan is appointed as partner in France and Hans Haderer in Germany

FIEE holds €127.5m first close for second fund

Fund targets the energy efficiency, renewables, lighting, co-generation, pollution control and smart city sectors

Muzinich Pan-European Private Debt II holds €210m first close

Fund provides capital to lower-mid-market companies to fuel their growth and finance their expansion strategy

Unquote Private Equity Podcast: H2 Preview

The Unquote Podcast gathers the whole team this week to go over H1 statistics, look at early recovery signs and share insights from across Europe

Multiples Heatmap: pricing ticks up as GPs flock to safe assets

Although dealflow was severely impacted by Covid-19 in Q2, average entry multiples actually went up given the scarcity of attractive opportunities

EQT Infrastructure in exclusivity to acquire IK's Colisée

During IK's three-year holding period, the company tripled in size, according to a statement

ArchiMed closes MED Platform I on €1bn

Oversubscribed fund closes above its €800m target after a couple of years on the road

Panakes to launch €120m second fund within months

VC expects to start raising capital by the end of the year and hold a first close in H1 2021

Ardian's Unither buys Chinese pharma company NRB

With this acquisition, Unither plans to accelerate the development of its business in China

Q2 Barometer: Coronavirus ravages European M&A market

After the first effects of the Covid-19 crisis were felt in March, the European private equity market decelerated sharply in Q2

HSBC Vision Private Equity 2020 closes on $260m

Fund targets a variety of private equity opportunities, from primaries and secondaries to direct co-investments

OakNorth Bank provides fund facility to BlueGem

Key investors include Glendower Capital, Blackstone's Strategic Partners and BMO Global Asset Management

STIC Investment, SoftBank Korea et al. acquire Systran

Fresh capital will go towards increasing delivery speed and geographic footprint

Calao Finance backs acquisition of Raidlight-Vertical

Raidlight and Vertical were since 2016 owned by Rossignol Group, a French winter sports group, which is owned by PE firm Altor

Antin to buy PE-backed Babilou

Company's founders Rodolphe and Edouard Carle will retain a minority stake in the business

EQT's Saur bolts on Derichebourg Aqua

Saur secures a 51% stake in the French water utilities management company as part of a strategic partnership

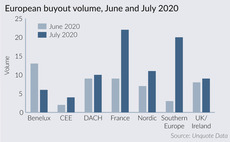

France, southern Europe drive dealflow uptick in July

Buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier

ICG launches second recovery fund

Second vehicle will be larger than its predecessor, which closed on тЌ843m in March 2010

Marlin invests in Pentalog

Marlin is currently investing from its Marlin Equity V vehicle, which closed on €2.5bn in March 2017

Axon launches €150m fourth innovation growth fund

Fondo Axon Innovation Growth IV acquires minority stakes in technology businesses with high-growth potential

Cathay, BPI-backed AD Education bolts on Ces

Add-on shortly follows the acquisition of Italian university Accademia Italiana Arte Moda e Design

Peninsular backs NovaSparks MBO

GP will partner with NovaSparks CEO Luc Burgun to consolidate in a range of financial markets