UK / Ireland

Seedcamp Fund IV holds £60m final close

Seedcamp's fourth fund has made 15 investments in the six months following its first close

Hg and ICG in £1.3bn Iris buyout

Hg6 generates a 4.2x return from the sale of the accounting software group, equivalent to a 26% IRR

Terra Firma mandates Christie & Co for Wyevale sale

GP has secured a 12-month extension to its 2007-vintage fund to enable the sale of remaining assets

NorthEdge's Direct Healthcare Group bolts on Qbitus

Following this last acquisition, Direct Healthcare expects to reach a turnover of £24m in 2018

Sovereign reaps 8x on sale of Kindertons to ExamWorks

Sale of the UK-based accident management business was based on EBITDA of around £20m

Foresight injects £3m into DA Languages

UK interpreting and translation business will look to expand its private sector activity

BC Partners launches real estate arm

Stéphane Theuriau, former CEO of Altarea Cogedim, is hired as managing partner

Edge leads £4m Hoop series-A

Deal will enable the online booking platform to expand its operations team and prepare for a US launch

PAI acquires M Group from First Reserve

Acquirer is currently investing from its sixth flagship fund, which writes equity cheques of €100-300m

BGF invests £3m in Ruroc

Company will use the fresh capital to support the launch of its new Atlas motorcycle helmet

Permira sells remaining Just Group shares

Final selldown follows GP's share sale in January, in which the investor sold shares worth £78.5m

Inflexion raises £2.25bn in double fundraise

GP also announces the launch of Inflexion Foundation, which will receive 1% of the vehicles' profits

Epiris acquires The Club Company from Lone Star

Deal is the third made by Epiris Fund II and reportedly values the country club chain at around £100m

NorthEdge hires two new portfolio directors

Keven Parker has experience from 3i, while Andy Tupholme previously worked at Gresham

Highland Europe injects $21m into Incopro

IP protection software and consultancy business will build out its Chinese operations

Blue Wolf acquires majority stake in TGW

Deal for the industrial knife producer was made with capital drawn from the GP's $540m fourth fund

GMT sells MeetingZone to trade for £61.4m

Sale ends a holding period of almost seven years for GMT Communications Partners

Livingbridge to acquire Love Holidays

Proposed deal will reportedly value the UK-based online travel agent at around £180m

Alliance of equals: PE's evolving buy-and-build approach

Portfolio companies are increasingly making larger bolt-ons, as GPs look for new ways to boost returns in a market with high entry multiples

Investec launches $100m venture fund

Vehicle will target UK fintech and enterprise software businesses between the seed and series-A stages

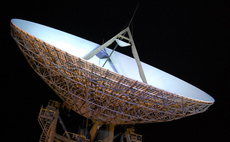

Downing exits Goonhilly

Exit marks the end of a four-year ownership after Downing acquired the firm in March 2014

Core invests in Alpine Fire Engineers

GP is currently investing from its second fund, which typically invests £5-15m per transaction

Bridgepoint preps for first credit fund launch

Firm's first debt vehicle will invest in Bridgepoint's own deals as well as third-party ones

Spice PE in $300m deal for The Craftory

GP is funding the launch of a new UK-based, consumer-goods-focused investment group