Unquote

Social concerns increasingly important in European consumer M&A

Ethical supply chains, modern slavery, diversity and inclusion, wage gaps, and health and safety are all "potential liabilities" for M&A sponsors

European ESG market to hit EUR 1.2trn by 2025 – survey

Segment could account for between 27% and 42% of private markets' asset base, up from 15% in 2020, says PwC

Spotlight on Spacs: Fintech fever

A sustained surge in fintech deal-making may well have Spacs to thank

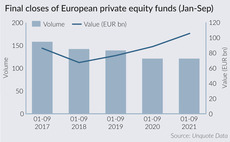

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate

Women in PE continue to earn less than male counterparts – survey

Survey by Heidrick & Struggles found that female principals in the UK are an exception to the trend

HKA owner Bridgepoint prepares exit

JP Morgan is in pole position to secure the sell-side mandate, sources say

PAI lines up next flagship fund

PAI Partners VIII is registered in Luxembourg, with its predecessor having raised EUR 5bn in 2018

European PE activity could reach EUR 400bn mark in 2021

Aggregate value for 2021 to date is already higher than that seen in any full-year on record, with a full quarter still to play out

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Fund financing and ESG: from the impact niche to the mainstream

ESG-linked fund financing facilities are becoming a prominent т and well publicised т tool in the ESG toolbox for GPs and lenders

Calpers, Carlyle lead LP-GP ESG Data Convergence Project

Initiative aims to bring about a standardisation of ESG reporting, with yearly reviews

SGT, Tyrus announce strategic partnership

Collaboration will focus on capital markets-related PE deals in the US and Europe

European IPOs reach seven-year high in first nine months of 2021

Sponsors have been on the ball when it comes to capitalising on the IPO window this year, according to Dealogic data

GP Profile: Gyrus looks to next steps after debut pandemic fundraise

Co-founder Guy Semmens discusses the GP's first-time fundraise, its deal pipeline, and the lead-up to its next fund

European sports get lifeline from PE funds

European sports teams are diving into the hands of financial sponsors, inspiring an unprecedented run of form for M&A in the space

Clearwater hires ex-PwC partner as new CEO

Julian Brown will take over from Michael Reeves, who has led the firm as CEO since inception in 2014

Illumnina Ventures closes second fund on USD 325m

VC operates independently from US business Illumina, a genetic variation and function technology firm

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

GP Profile: HPE Growth sets the stage for next fundraise

Manfred Krikke and Tim van Delden on the firm's growth plans, fundraising intentions, and the importance of European digital technology

Dawn promotes Plotnikova to general partner

Evgenia Plotnikova is the youngest woman promoted internally to general partner in Europe, Dawn says

Triago hires Apposite's Auffray as new London partner

Matt Swain and Victor Quiroga are named co-heads of the Americas in NYC

Podcast: In conversation with… Adam Turtle, Rede Partners

Turtle joins the podcast to discuss the firm's journey over its first decade and the main trends in the European fundraising landscape

Langholm winds up remaining assets in Verdane sale

Sale of WoolOvers, Purity Soft Drinks and Lumene sees Langholm wind up its remaining assets