Germany

Target and HTGF in $2.6m Simplaex series-A

Deal is the first of the year for Target and the 15th for High-Tech Gründerfonds

BayBG takes minority stake in ISOG restructuring

Restructuring plan approved at the start of May means the company will keep its HQ and secure 85 jobs

HTGF in €1.5m seed round for Replex

Fresh capital will be used to expand into the US market, with a new office recently opened in San Francisco

Terra Firma invests in Equistone's Sportgroup

Terra Firma will provide further support and advice but will not be involved operationally

EMBL and Life Sciences Partners sell Luxendo to Bruker

Bruker will expand its portfolio with the addition of Luxendo's microscopes and intellectual property

Innogy Ventures leads €13m series-C for Move24

Move24 plans to hold further closes for the round, potentially raising up to €20m over the next eight weeks

Ringier, BtoV, et al. in €6m round for Foodspring

Company will use the fresh capital to expand into other European countries and develop its food products

Project A sells Minodes to Telefonica Next

Fifth exit from Project A's first fund, which held a final close on €80m in 2012

IK Investment Partners acquires Messerschmitt Systems

German hotel management systems developer will use the extra funding for international expansion

EQT's Getec acquires Urbana

EQT's portfolio company strengthens its presence in the northern Germany energy sector

Finlab and Coparion back Fastbill

Extra capital will be used to support the company's growth by expanding the financial platform

HTGF sells Collinor to Godesys

Medium-term goal of the acquisition is to integrate Collinor's software into Godesys's project management systems

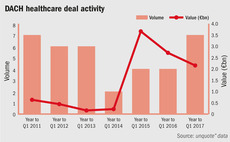

Shot in the arm for DACH healthcare market

Consolidation opportunities in the mid-market fuel increased investment from private equity, with aggregate volume reaching a six-year high

DBAG sells Romaco to Truking Group

DBAG will initially sell around 75% of the company from its balance sheet and its vehicle DBAG Fund V

Bitkraft holds €18m first close for eSport venture fund

Fund is targeting a final close on €30m and has already invested in 10 eSport companies

Digital+ Partners leads €13.5m series-B for Riskmethods

New capital will be used to accelerate product development and further international expansion

HQ Equita sells Isolite group to Hitachi Chemical

HQ Equita acquired Isolite using capital from Equita Holding in 2010

IFH backs HQLabs

Company will use the extra funding to further develop its software platform and hire more staff

Bain and Cinven publish Stada offer document

Offer values company at €5.3bn, the largest PE-backed takeover bid ever launched in Germany

Oakley Capital appoints Schremper as new partner

GP aims to bolster its presence across the DACH region with the hire of a new partner

HgCapital sells Qundis for 3.5x money

Exit represents a 3.5x investment multiple for HgCapital and a 30% gross IRR, with cash proceeds of £36.9m

Picus Capital and IBB in €2m seed round for Getsurance

New funding will be used to bring the company's digital disability insurance product to market

HTGF and IFH back KSK Diagnostics

New funding will be used to develop point-of-care tests by utilising isothermal amplification technology

BC Partners sells SGB-Smit to OEP

Transaction involves a €590m all-senior debt package, €340m term loan B and €250m undrawn facilities