High-Tech Gründerfonds

HTGF backs WhatsBroadcast in €5m series-A

Investors include Müller Medien, Media + More Ventures, Wessel Management and minority shareholders

HTGF, HIF in €800,000 round for Rodos Biotarget

Otto Gies previously invested in the company via crowdfunding platforms Seedmatch and Aescuvest

HTGF, IFH sell Custom Cells to P3 Group

Altana also made a financial exit but will continue to cooperate with Custom Cells operationally

HTGF backs €7m seed round for Zimmer Biotech

Zimmer Biotech will focus on developing a skin cancer drug based on 5-Aminolevulinic acid

HTGF sells stake in Evoxx to Advanced Enzyme

High-Tech Gründerfonds is selling its stake in the biotech firm after a 10-year holding period

HTGF and MBG back €720,000 seed round for Stimos

HTGF says the technology addresses a problem affecting patients and the health economy

HTGF in €3m series-B round for POS Pulse

Round was led by former Schleich managing director Paul Kraut along with moebel.de founder Robert Kabs

High-Tech Gründerfonds sells Fruux

GP sells its stake to the company's founding partner after a five-year holding period

HTGF, Media Ventures et al. in $8.5m round for Make.tv

Corporate venture players Voyager Capital, Microsoft Ventures and Vulcan Capital also back the round

VCs exit Propertybase to Boston Logic

Neuhaus Partners, HTGF, Bayern Kapital and BayBG all report a successful exit from the investment

HTGF holds first close for third fund on €245m

Fund has a target of €300m and will begin making early-stage investments in Q4 2017

Helvetia Venture Fund leads funding round for Baimos

HCS Beteiligungsgesellschaft, Berendsen Holding, High-Tech Gründerfonds and Bayern Kapital also invest

Principia leads €6.5m series-B for neurology firm Wise

Existing investors Atlante Ventures, High-Tech Gründerfonds, F3F and Antares join the round

HTGF, Kima exit eWings.com in trade sale

Hogg Robinson Group enters into an agreement to acquire the digital business-travel service

One Peak, Morgan Stanley invest €22m in Ecointense

Transaction constitutes an exit for BBAF and Wecken & Cie, while HTGF retains a significant stake

42Cap, HTGF and Littlerock in €1.8m round for MoBerries

Company will use the new funding to develop its technology and expand operations internationally

LSP leads €15m series-A for Cardior Pharmaceuticals

New funding will allow the company to develop its lead compound, which targets RNAs linked to heart failure

HTGF et al. invest in Numaferm

European Investment Fund and angel investors also participated in the seed funding round

Target and HTGF in $2.6m Simplaex series-A

Deal is the first of the year for Target and the 15th for High-Tech Gründerfonds

HTGF in €1.5m seed round for Replex

Fresh capital will be used to expand into the US market, with a new office recently opened in San Francisco

HTGF sells Collinor to Godesys

Medium-term goal of the acquisition is to integrate Collinor's software into Godesys's project management systems

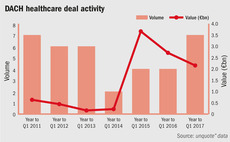

Shot in the arm for DACH healthcare market

Consolidation opportunities in the mid-market fuel increased investment from private equity, with aggregate volume reaching a six-year high

HTGF and IFH back KSK Diagnostics

New funding will be used to develop point-of-care tests by utilising isothermal amplification technology

HTGF et al. sell Symetis to Boston Scientific for $435m

Companies have developed complementary heart valve technologies