Italy

Syntegra's Moleskine launches IPO

Syntegra Capital has launched the IPO of portfolio company Moleskine in a listing that could value the business at up to €530m.

Southern Europe unquote" March 2013

Portuguese private equity hit an all-time low in 2012. While most investors made a full retreat, those that remained stumbled through the economic turmoil and completed just two transactions.

Alpha's Savio bolts on Mesdan

Savio Macchine Tessili, a textile machinery producer owned by Alpha, has acquired a controlling stake in yarn splicing devices firm Mesdan.

Moleskine to list this month

Notebook and diary brand Moleskine, owned by Italian GP Syntegra, will list on the Milan stock exchange this month.

New Italian VC launches with Fondo Italiano backing

Fondo Italiano di Investimento has committed capital to United Ventures, a newly-formed venture capital firm based in Italy.

Clessidra to make another offer for Telecom Italia

Italian GP Clessidra is to make a new offer for Telecom Italia Media, according to reports.

Advanced Capital appoints new CEO

Advanced Capital, a European alternative investment specialist founded by financier Robert Tomei, has appointed Robert Berlé to CEO.

Acanthus: Private equity fundraising remained tough in 2012

Research from mid-market advisory firm Acanthus shows that 2012 saw an even tougher fundraising climate than the previous year.

Amadeus Capital Partners backs Bellco

Amadeus Capital Partners has entered the shareholding of Italian dialysis technology company Bellco, owned by Montezemolo & Partners.

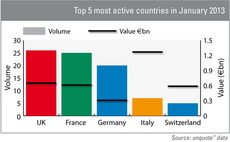

Italy shines in January thanks to CVC mega-buyout

Italy topped Europe's private equity value charts in January, while the UK recorded the most deals, showing both familiar names and outliers starting 2013 on a high.

Private equity-backed Eco Eridania bolts on three

Waste management firm Eco Eridania, backed by Fondo Italiano di Investimento, has acquired three companies: Paderno Energia, Elettrochimica Carrara and Technoplus, the waste management arm of Ghi.be.ca.

Clessidra loses out on Telecom Italia

Italian private equity house Clessidra has lost out on national television network Telecom Italia as the company entered into exclusive talks with media firm Cairo Communication, according to reports.

Argos Soditic buys FIS and Antex

Argos Soditic has acquired a majority stake in Italian firms FIS and Antex, which operate human resources and finance and administration outsourcing services, through the newco Fahr Servizi.

Southern Europe unquote" February 2013

“The 2006 acquisition of Avio represented what today remains the largest leveraged buyout ever completed by a single private equity house in Italy,” says Roberto Italia, partner at European buyout house Cinven.

Ambienta plans €300m fund

Italian environmental investor Ambienta is looking to raise €300m for its second fund, according to reports.

Italy: Diamond in the rough

Diamond in the rough

21 Partners backs Farnese Vini

21 Partners has acquired a majority stake in Italian wine producer Farnese Vini, according to reports in the local press.

Video: Private Equity Partners' Fabio Sattin

Amy King talks to Fabio Sattin, founder and chairman of Private Equity Partners, about why Italy has struggled to attract foreign investment.

Principia backs Simplicissimus with €2m

Italian venture investor Principia has injected €2m into Simplicissimus Book Farm, a digital solutions provider for the publishing sector.

German Unicredit unit considers sale of PE stakes

HypoVereinsbank, the German unit of Italian bank Unicredit, is reportedly considering the sale of its private equity fund stakes in a stapled secondary transaction.

Orlando Italy buys struggling Fnac division

Orlando Italy has acquired FI Holding, the holding company of music and book retailer Fnac Italia, from parent company PPR.

Moleskine: a jewel in Italy's crown

Moleskine IPO

AlixPartners promotes eight across European offices

Advisory firm AlixPartners has promoted three team members to managing director and another five to the position of director.

PPF Group regains control of private equity operation

CEE-focused financial services group PPF Group has acquired 27.5% of its own private equity funds business from Italian insurer Assicurazioni Generali.