Omnes Capital

Consortium raises €21m for AgomAb

Representatives from V-Bio, Advent Biotechnology, BIVF, Omnes and Pontifax have joined the board

Omnes, M Capital Partners lead €5m round for Therapixel

Therapixel won the Dream Digital Mammography Challenge in 2017, winning €1.2m in prize money

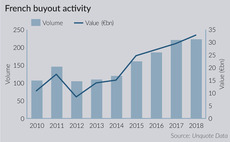

French buyout value climbs to post-crisis peak

Total deal value comfortably surpasses 2017's figure in a market driven by fierce competition, high prices and easy access to debt

Omnes, Turenne lead €7m round for Teach On Mars

Turenne draws capital from its Région Sud Investissement fund to support the round

Omnes backs ABMI in MBO

Omnes invests €10.8m in France-based engineering and industrial advisory firm ABMI

Omnes, BPI France back UnitE

GPs invest in the France-based hydropower specialist via renewables-focused funds

Omnes holds €72m interim close for Expansion III

GP plans to hold a final close in H1 2019, sets target at €120m and hard-cap at €150m

Omnes, BIP buy Captain Tortue

Founders, Philippe and Lilian Jacquelinet, have reinvested for a significant stake

PE-backed Sentryo raises €10m series-A

French industrial internet cybersecurity specialist previously raised a €2m seed round in 2016

VC-backed Themis announces IPO price range

Size of the offering for Austria-based Themis is €55.3m – at the high-end of the price range

Omnes to launch fourth Capenergie fund in Q3 2019

Energy-transition-focused Capenergie IV has a €500m target, double the size of its predecessor

Push for breakthrough in French renewables

PE players are increasing their focus on the country's renewable energy sector, despite the high profile challenges faced in the space

Omnes hires and promotes staff

GP announces a series of changes in its mid-cap, small-cap, VC and infrastructure teams

PE-backed Neoen prepares for IPO

France-based Neoen, a renewable energy project developer, plans to raise around €450m

Omnes backs MBO of Marquetis

Group is exploring new partnerships in the local market with the additional capital

Omnes-backed Batiweb bolts-on HelloArtisan

Batiweb is aiming to provide a full service to individuals working on renovation projects

Omnes et al. in series-B round for Tiller

GPs will provide a €12m equity ticket and can deploy up to €8m in the next 18 months

Omnes et al. back Mistral MBI

Transaction is the first investment from Omnes Capital's small-cap Omnes Expansion III fund

Omnes holds €30m first close for Omnes Expansion III

Omnes' third small-cap vehicle receives €30m in commitments from historic backer LCL

Omnes Capital in €3.5m funding round for Tilkee

Evolem Start, Crédit Agricole Création, Axeleo Capital and Kreaxi also take part

VC firms in $60m funding round for Scality

Galiléo Partners, Omnes Capital, Idinvest, Iris Capital, Menlo Ventures all take part

Omnes sells Adictiz to trade

Omnes Capital invested €2m in French video games developer Adictiz in 2012

Oxatis announces intention to float

Oxatis, a French PE-backed e-commerce SaaS developer, will float on 24 April

Omnes launches new funds

Omnes Real Tech, Omnes Expansion III amd Mezzanis III expected to hold closes in 2018