Research

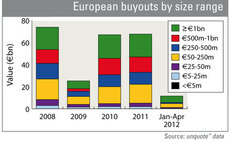

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

Governments' contribution to VC up six-fold

Government agencies and corporates are increasingly active in venture – but they should push further in support of European VC, argues Olivier Marty

SBOs set to rebound

The recent quaternary buyout of French eyewear retailer Alain Afflelou by Lion Capital for an estimated €780m shows that the "pass-the-parcel" trend in private equity has not yet abated.

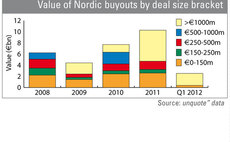

Nordics seen as investment safe haven

The тЌ1.8bn sale of Ahlsell to CVC Capital Partners in February drew renewed attention to the thriving Nordic buyout market.

Nordic sentiment: have your say

The Nordic private equity market has hit a few bumps in its road to recovery, with taxation issues overshadowing the regionтs otherwise impressive growth.

University and college spinouts make a timid rebound

The funding of Arvia, a spinout from the University of Manchester's School of Chemical Engineering, by MTI Partners for £3.8m is the latest of nine university spinouts noted since the year started.

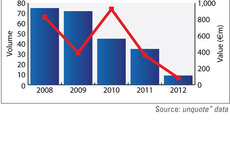

Declining activity belies venture successes

Although European venture capital activity decreased by 12% to €974m last year, 2011 saw a number of sizeable fund closes as well strong exits, indicating fresh appetite for the asset class.

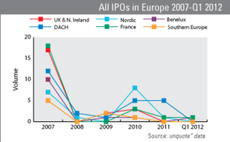

Europe's IPO comeback

Private equity-backed IPOs have had a rollercoaster ride in Europe over the last five years.

CEE's mid-market boom

CEE activity was subdued but with encouraging signs in 2011. Q1 saw just €1.7bn clocked up, but this was twice the sum of the whole of the previous year. Also, although activity in H2 was quiet, year-end figures nearly doubled to €2.6bn year-on-year....

Have your say: unquote" Watch

With the Chancellorтs latest Budget rapidly approaching, is the UK government doing enough to support investment? Is the industry facing significant refinancing issues over the next two years?

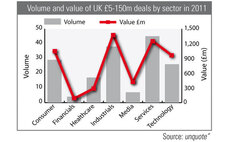

Business services keeps UK mid-market ticking

The UK's hugely important services sector remained key to the private equity market in the ТЃ5-150m segment. The 45 deals recorded in 2011 makes it easily the most important in volume terms, while its lower average deal size leaves it number two behind...

Investments by regional funds

The volume of investments backed by regional initiatives has followed the general market curve of recent years: after the boom year of 2007, they plunged.

Unquote" Regional mid-market barometer

The latest Unquote" Regional mid-market barometer, produced in association with LDC, shows recovery was bolstered by prospering small caps in 2011, with total value of over ТЃ5.4bn across 166 deals.

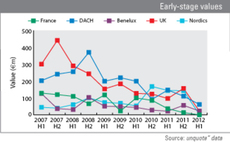

Early-stage deal rate highest in Europe

A look at early-stage activity in 2011 across Europe shows the DACH region is consistently the strongest player in the early-stage market, followed by the UK & Ireland.

Early-stage and Nordics stand out

2011 was a bleak year for the private equity industry, but it was still an improvement on 2010, writes Olivier Marty

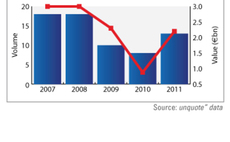

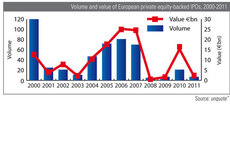

Private equity-backed IPOs, 2000-2011

In appreciation of Facebook's massive IPO last week, unquote" data shows the volume and value of private equity-backed IPOs from the dot-com bubble through the financial crisis of 08/09, up to last year.

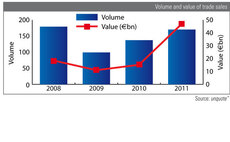

2011 exits: trade sales almost triple in value

As the graph shows, the proportion of trade sales, the most common exit route, has not changed significantly between 2010 and 2011.

unquote" UK Watch Q4 2011

The latest unquote" UK Watch, produced in association with Corbett Keeling, reveals Britain has a thriving smaller buyout segment, but at the cost of waning larger deals.

unquote" private equity barometer - Q3 2011

Deal activity levels fell by more than a third in Q3 2011 due to ongoing fears regarding the European debt crisis, according to the latest unquoteт Private Equity Barometer, in association with Arle Capital Partners.

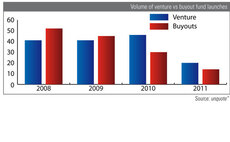

Volume of buyout vs venture fund launches

In 2010, launches of venture funds surpassed buyout funds for the first time in 5 years, but the gap has narrowed in 2011.

unquote" private equity barometer - Q4 2011

There was a major drop-off in overall deal volume in Q4 2011, with a continuing contraction across all deal stage segments resulting in a total of just 192 deals, the lowest figure recorded since Q4 1996 (158).

unquote" watch: Take our 60-second survey

Deal activity levels dipped below paltry Q3 figures, highlighting the hibernation the industry is in the midst of.

Nordic Survey 2011

The first edition of the Nordic Survey 2011, in association with Delphi, assesses market sentiment among the region's private equity professionals.

unquote" Nordic Private Equity Index Q3 2011

Nordic private equity activity saw a slowdown in the third quarter, mirroring that seen in the rest of Europe.