Articles by Greg Gille

Swen recruits two to launch Blue Ocean impact strategy

Christian Lim and Olivier Raybaud join as managing directors to focus on ocean regeneration

YFM scores 6.5x on Deep Secure exit

Deal shortly follows the 6x exit of YFM's FourNet stake to Palatine Private Equity

17Capital provides portfolio finance facility to Investcorp

Deal results in exposure to a portfolio of PE, real estate and credit assets in the US and Europe

CVC fully exits Wireless Logic

Montagu Private Equity and management buy out CVC's minority stake

Oakley hires new partner, makes raft of promotions

GP makes six promotions within its investment team, and hires Valero Domingo as partner

Equita targets €140m for Italian SME fund

Equita Smart Capital – ELTIF is open to both institutional investors and select retail clients

Rothschild closes second Five Arrows multi-strategy PE fund on €366m

Fund targets fund investments, late primaries, secondaries directs and direct co-investments

CMBOR returns to Nottingham University after 2020 hiatus

Centre for Private Equity and MBO Research is re-established within Nottingham University Business School

Unquote Private Equity Podcast: First-time fortunes

Vincent Van den Brink and Greg Kok from fund administrator JTC discuss how recent months have affected the fortunes of first-time funds

CGT rate hike to curb HNWI investment appetite - survey

One in four private investors would reduce their investments into SMEs by 50% or more, says Connection Capital

Oakley backs ICP Education buyout

Oakley will deploy via Oakley Capital Fund IV, which held a final close on €1.46bn in 2019

Sanne board rejects fourth Cinven offer

Latest proposal offers 850 pence per share, a small uptick on the 830 pence offered earlier

Mobeus scores 3.3x on Ludlow trade sale

GP sells financial advice business Ludlow Wealth Management to Mattioli Woods for £36m

Vectura board greenlights £958m Carlyle offer

Vectura Group is a listed, UK-based developer of inhaled drug delivery devices

Funds maturing in 2021: what is still in PE and infra portfolios

Unquote and Inframation delve into seven of the largest funds maturing around 2021 to highlight potential M&A and secondaries opportunities

Omnes closes Capenergie 4 on €660m

Fund exceeds its €500m target and initial €600m hard-cap, having launched in late 2019

Omers buys into Partners Group's International Schools Partnership

Deal gives the international group of K-12 schools an enterprise value of €1.9bn

Foresight hits £65m first close for Regional Investment III

Fund has Greater Manchester Pension Fund as its cornerstone investor

PE-backed IPOs on track for best year since 2017

This year has already seen 26 portfolio companies listing, with a total offering volume approaching €12.7bn

RBS appoints new fund finance director in Luxembourg

Bank appoints Philip Prideaux to drive its Luxembourg funds banking offering

Eurazeo to ramp up divestments over next 24 months

Firm also expects fundraising to exceed the previous record of €2.9bn set in 2020

Mobeus hires three in growth team

Investment director Joe Krancki joins from Frog Capital, where he was a partner

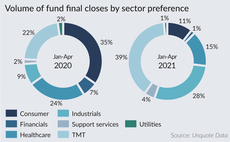

PE funds raised in pandemic increasingly target TMT opportunities

GPs' origination preferences and 2020 investment volume have already shown a clear shift to technology investments, with new fundraises following suit

LDC backs PR firm Headland

LDC has history investing in PR consultancies; the GP backed Blue Rubicon from 2012 to 2015