Articles by Greg Gille

European Direct Lending Perspectives Q4 2020

Only 9% of market participants anticipate coronavirus negatively impacting fundraising in 2021, with a majority expecting deployment to pick up

Unquote Private Equity Podcast: the price is right?

Following the publication of the Q4 2020 Multiples Heatmap, Unquote welcomes Clearwater's executive team to discuss pricing trends

CVC injects £365m into Six Nations rugby tournament

Long-awaited deal finally crosses the try line, with initial approaches starting two years ago

Passion Capital opens third fund to retail investors through Seedrs

Passion launched the fund in late 2017 and has already made 11 deals through the vehicle

Ardian takes minority stake in Kapten & Son

Ardian Growth strikes first deal in Germany with investment in fashion and accessories retailer

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Bure launches first Swedish SPAC, aims to raise SEK 3.5bn in IPO

Bure says the initiative has been enabled by Nasdaq Stockholm's new SPAC regulations

Ropes & Gray adds partner, counsel to private funds team

Emily Brown joins the law firm as partner, while Chris Townsend is hired as counsel

Majority of LPs happy to commit without in-person meeting – survey

Cebile Capital survey finds that 51% of respondents expect to increase PE commitments in 2021

Sharp focus on top assets boosts average multiple in consumer sector

Covid-resilient assets are the only ones coming to market, with suitably hefty price tags, says Clearwater's O'Donnell

Iron Wolf Capital eyes €30m-plus fund launch after 2023

Baltic venture capital investor raised €21m for its first fund in 2019

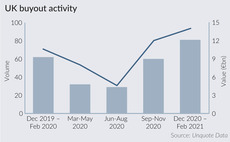

How UK PE buyouts soared ahead of 2021 Budget

Amount of dealflow in the past three months is significantly higher than in previous December-February periods

Bowmark, LDC sell Node4 to Providence

IT business was expected to fetch a valuation in excess of £300m, based on a 15x multiple

Synova sells Tonic Games to Epic, nets 200% IRR

Exit closely follows that of Fairstone Group to TA, which resulted in a 4.5x return

Download the March 2021 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers

Virgin Wines floats in £110m IPO, Connection reaps 7.6x

Mobeus remains invested in the business, while Connection makes a full exit

FRP buys Spectrum Corporate Finance

All 27 Spectrum employees will join FRP following the £9.4m deal

France: strong deals pipeline fuels high average entry multiple

Sponsors fight tooth and nail for prized assets in defensive sectors such as healthcare, higher education and financial services

Virgin wines prices IPO, set for £110m float

Selling shareholders, including Mobeus and Connection Capital, will reap £35m

Synova scores 4.5x on sale of Fairstone to TA

UK-based IFA consolidation platform is the first exit for Synova's third fund

Multiples Heatmap: average pricing hits 11x in busy Q4

Healthcare, financial services and TMT assets continue to drive valuations up, while Nordic and UK regions see highest multiples

17Capital hires Chatin as IR and fundraising director

Chatin will manage European investors, with an emphasis on French-speaking countries

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Afinum back on road for ninth fund

Predecessor vehicle, which raised €410m in 2017, is now 86% deployed