Articles by Greg Gille

Unquote” Regional Mid-Market Barometer

The latest unquote" Regional Mid-Market Barometer, produced in association with LDC, shows that mid-cap investors are not letting a lacklustre economy hamper their ability to close deals.

Alven injects €1m into iAdvize

Alven Capital has invested €1m in French online customer relations services provider iAdvize.

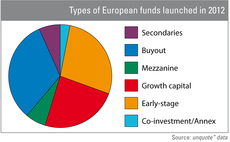

Secondaries and mezzanine vehicles proving popular in 2012

Looking at the funds launched so far this year in Europe shows sustained appetite for mezzanine and secondaries vehicles, reflecting current investment opportunities and subsequent LP interest for the private debt and secondaries markets.

Electra Partners hires investment manager

Electra Partners has hired ex-GCP Capital principal Ian Wood as an investment manager.

Advent launches takeover offer for Douglas

Advent International has made a tender offer to acquire listed German perfume and books retail group Douglas, which would value the business at close to €1.5bn.

Naxicap takes majority stake in IMX France

Naxicap Partners is understood to have backed the management buyout of French delivery services company IMX France.

PE-backed eFront acquires DMLT

eFront, a Francisco Partners-owned software provider targeting the alternative investment industry, has bought US-based DMLT.

Carlyle awarded second extension for Chemring bid

Carlyle has been granted a second extension on its deadline to make an offer for British military supplier Chemring.

FSI Régions and SGCP back WC Loc OBO

FSI Régions and Société Générale Capital Partenaires (SGCP) have taken a minority stake in the owner buyout of WC Loc, a French sanitation fixtures rental business.

Baker & McKenzie appoints global PE chair

Law firm Baker & McKenzie has appointed partner Simon Hughes as chair of its global private equity group.

Accel Partners leads $40m round for HouseTrip.com

Accel Partners, Balderton Capital and Index Ventures have taken part in a $40m series-C round of funding for UK-based international holiday home rental website HouseTrip.com.

August sells Enara for £111m

August Equity has sold UK-based domiciliary care provider Enara to listed trade player Mitie for £111m.

EdRIP and Iris back ProwebCE take-private

Edmond de Rothschild Investment Partners (EdRIP) and Iris Capital have backed the take-private of French support services business ProwebCE, alongside trade player Edenred.

AXA PE appoints private debt co-head

AXA Private Equity has promoted Olivier Berment to co-head of its private debt business.

Four European mid-cap players team up, create Private Equity Network

Activa Capital, Graphite Capital, ECM and MCH have launched the Private Equity Network (PEN), a pan-European initiative designed to help their portfolio companies expand internationally.

TCR invests in In'Tech Medical

TCR Capital has acquired a stake in French orthopaedic devices manufacturer In'Tech Medical, alongside Arkea Capital.

Apax France buys Texa

Apax France has bought Texa, a French insurance services business, alongside the company's founder and management in a quaternary buyout from Pragma Capital.

LDC's A-Gas buys US-based Coolgas

LDC-backed A-Gas International has bought Coolgas, a US-based refrigeration supplier and distributor.

Apax France reinvests in Afflelou, secures 14.1% stake

Apax France has reinvested in French eyewear retailer Alain Afflelou, four months after exiting the business in an SBO backed by Lion Capital.

Greenpark promotes Daniel Green to CIO

Secondaries player Greenpark Capital has promoted Daniel Green to chief investment officer.

French PE industry “could collapse”, AFIC warns

French PE industry

UK Green Investment Bank appoints ex-PE exec as CEO

State-backed Green Investment Bank has appointed Shaun Kingsbury, a former partner at private equity house Hudson Clean Energy Partners, as chief executive officer.

Apax's Mann leaves, replaced by healthcare co-head

Senior healthcare deal-maker Khawar Mann has left Apax Partners to join Russian clinics group Medsi.

Amundi takes 7.5% stake in French GP NextStage

French asset manager Amundi has bought a 7.5% stake in small-cap specialist NextStage from financial holding Artémis.