Articles by Oscar Geen

DPE tests LP appetite for fourth fund

DPE III held a final close in €575m in January 2017, up from the €350m raised by DPE II

Afinum-backed Liftket buys Chainmaster

Chainmaster will continue to operate independently but will benefit from synergies

VC firms sell Mendix to Siemens for €600m

Mendix has raised $38m in equity funding from VC firms since it was founded in 2005

Debevoise hires Kirkland's Dickman

Dickman will be responsible for fund formation, management and reorganisation advice

Adcuram buys MEA Group

Corporate finance house Raymond James acts as exclusive financial adviser to MEA's shareholders

Ogier promotes two

Delamarre and Elslander earn promotion to senior associate after joining the firm in 2014 and 2016

Applegreen, Equitix, Arjun to buy NIBC's infra portfolio

Applegreen will acquire a 55% stake in motorway service provider Welcome Break in the transaction

Finatem buys GfS

Fourth investment Finatem has made in 2018 and the sixth from its latest buyout fund

BGF invests £6.4m in Miss Group

Fresh capital will be used to further scale the business and drive international expansion

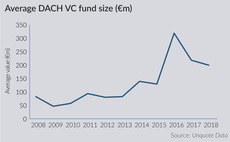

VC fundraising lifts off in DACH region

Six venture funds based in the DACH region have held final closes in 2018 for a combined €1.3bn

Resilience Partners targets final close for direct lending fund

Spanish direct lender is targeting a February 2019 final close for its maiden fund

JC Flowers sells OneLife to trade

New group will have a combined AUM of €16.5bn, €5.2bn of which is currently managed by OneLife

Paragon buys Innere Medizin from UCB

Paragon draws equity from its €412m buyout fund, which held a final close in 2017

VC firms back $55m series-B for ReViral

Round is led by New Leaf Venture Partners and Novo Ventures, alongside new and existing investors

3i-backed Ponroy buys Densmore

Second bolt-on the group has made since 3i's initial buyout of the business in 2016

DPE sells Ziegler to trade for €125m

GP makes the divestment from DPE Deutschland II, a €350m buyout fund that closed in 2012

CapVest targets €1bn for fourth fund

Vehicle is a significant increase on CapVest Equity Partners III, which closed on €482m

DACH leads lower-mid-market fundraising

An overcrowded lower-mid-market in the Nordic region and the UK, coupled with Brexit, has boosted DACH fundraising activity

Aleph, Crestview invest €260m in Keyhaven-backed Darag

Darag has completed 23 run-off transactions in Europe with a total value of more than €740m

Afinum buys Zeit für Brot

GP draws equity from its €410m fifth buyout fund Afinum Achte Beteiligungsgesellschaft

CareVentures holds first close on €60m

Vehicle was registered in Luxembourg as CareVentures Fund II SCSP in April this year

Green Arrow nears close for two funds

Investment firm Green Arrow Capital wholly acquired Italian GP Quadrivio Capital in November

Digital+ Partners holds final close on €350m

Vehicle was launched in 2016 with a €300m target and held a first close on €131.5m in 2017

GP Profile: Lakestar

Unquote speaks to founder Hommels about the VC's future ambitions and the European venture landscape