Industry

Polaris holds first close for Flexible Capital fund on DKK 500m

Vehicle was launched in May 2021 with a target of DKK 1bn and is expected to start deploying capital this quarter

Eight Advisory opens Cologne office; appoints KPMG's Luchtenberg

Fourth German office will be headed by Curt-Oliver Luchtenberg, who has joined from KPMG

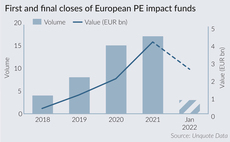

PE impact fundraising surpasses EUR 4bn in 2021

Figures from Unquote Data reflect the increasing prevalence of impact and impact-driven deals

Tikehau records EUR 6.4bn in fundraising in 2021

GP deployed EUR 5.5bn from its private equity, private debt and real estate funds in the same year

CapMan commits to science-based targets for net zero

Commitment is part of the GP's ESG strategy across the firm itself and its portfolio

Nordic Capital bolsters team with seven promotions

Among the appointments, Chris Lodge and Peter Thorninger are promoted to partners

Split the difference – corporate divestitures set records

Firms have taken advantage of favourable conditions for M&A, including cash-rich and ever-bolder PE funds

EMEA M&A surges in 2021

More than 10,500 M&A deals were recorded in 2021, worth a combined USD 1.54trn

FSI buys 60% of Iccrea's digital payments arm at EUR 500m EV

Carve-out deal is the ninth investment from FSI I, which closed on EUR 1.4bn in February 2019 and is now 75% deployed

CVC co-founder Koltes to step back in 2022

Steve Koltes co-founded CVC in 1993 and is to step back from an active role from 1 October 2022

VNV announces European growth plans and hires four investors

Sweden-based technology investor has been listed on the Swedish stock exchange since 1997

IDI to buy minority stake in Omnes

Further details are expected to be announced in the coming six weeks, according to a statement

Beringea promotes three to partner

VC firm has announced the promotion of Eyal Malinger, Maria Wagner and Vanessa Evanson-Goddard to partner

GP Profile: Triton lays out ESG plans

ESG head Graeme Ardus and recently appointed head of sustainable investing Ashim Paun detail the firm's approach to ESG

Dawn Capital makes series of promotions and hires

Announcement includes the promotion of Henry Mason to partner; he joined the B2B software VC in 2016

Planet First seeks sustainability investments ahead of EUR 350m fund close

Managing partner and co-founder FrУЉdУЉric de MУЉvius speaks to Unquote about the firm's evergreen fund and its investment strategy

LDC bumps up "growth agenda", renews focus on consumer

Mid-cap investor aims to invest in up to 100 businesses over the next five years following a тstandoutт, competitive market in 2021

Värde announces three partner promotions

Alternative investment firm has promoted Jim Dunbar, Aneek Mamik and Carlos Sanz Esteve to partner

Eurazeo hits EUR 5.2bn fundraising record in 2021

GP raised EUR 3.1bn for its PE strategies and plans “a major fundraising programme” in 2022 and 2023

Aurelius bolsters UK team with new hires and promotions

New joiners to strengthen London team and Peter Woods is promoted to managing director

Grant Thornton hires new head of corporate debt advisory

Fieldhouse brings with him 16 years of deals experience in consultancy firms

Buy-and-build a "super opportunity" for PE in healthcare services – panel

Dermatology, ophthalmology and diagnostic imaging all present attractive consolidation opportunities, panellists said

Cairngorm appoints three to investment team

Adam Watson and Sheena Pattni join as investment managers, and George Buckle as investment associate

Greenhill hires Silverfleet's Harrison

Andrew Harrison will advise on capital raising across entities including funds and co-investments