CEE

CVC invests in FutureLife

CVC acquires a co-controlling stake alongside current investor Hartenberg Holding

2022 Preview: Sponsors toast to incredible year, but remain wary of hangover

Many sponsors are anticipating that 2022 could be just as busy as 2021, in spite of mounting headwinds

Turkven, Earlybird to reduce Mikro Yazilim stakes in upcoming IPO

Mikro Yazilim, a Turkey-based software company, intends to float a 54.34% stake on Borsa Istanbul

Most LPs seek to improve co-investment appeal – Coller Capital

Coller Capital's winter 2021-22 Global Private Equity Barometer covers topics including secondaries

Q3 Barometer: PE scales new heights

The latest Unquote Private Equity Barometer, produced in association with abrdn, is now available to download

TCV-backed Grupa Pracuj lists in EUR 1bn IPO

TCV first invested in the Poland-headquartered online recruitment platform in 2017

PE firms study rivals' IPOs as they consider options

Recent slew of peer listings such as Bridgepoint and Petershill inspire key players as they mull options for their own businesses

Unquote Private Equity Podcast: To 12x and beyond

The Clearwater International Multiples Heatmap reveals that average entry multiples broke new records in Q3, on the back of a still-buoyant M&A market

Vitruvian's Bitdefender hires advisers for IPO-led exit

Romanian cybersecurity company appoints JP Morgan and Morgan Stanley for a dual-track process

Average fund size reaches new heights amid stark market bifurcation

Average buyout fund close for 2021 stands at EUR 1.33bn, more than double the EUR 629m recorded in 2017

Multiples Heatmap: TMT deals inked in Q3 pass 19x mark

Average entry multiples were again pushed into record territory in Q3 on the back of a still-buoyant M&A market

PE funds rework packaging investments around ESG concerns

Can private equity's decades-long love affair with the packaging industry last?

General Atlantic flagship fund GA 2021 closes on USD 7.8bn

Sixth flagship growth equity fund is more than twice the size of its USD 3.3bn predecessor

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

Unquote Private Equity Podcast: Leisure sector cleared for take-off

Unquote looks back at how the sector has fared, and speaks with PAI partner GaУЋlle d'Engremont following the ECG deal

Consumer dealflow rebounds strongly in Q3

More on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows

Startup Wise Guys raising up to EUR 52.5m across three funds

Estonian VC is raising Cyber Fund I, its second Challenger Fund and its Opportunity Fund II

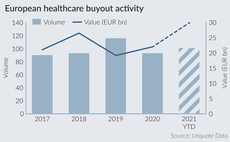

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

Will private equity bank on rising interest rates?

Sponsors want in on banking businesses before greater confidence in asset quality and interest-rate hikes increase valuations

Podcast: In conversation with... Sunaina Sinha, Raymond James | Cebile

The Cebile Capital founder discusses the tie-up with Raymond James, and the key trends at play in the global fundraising and secondaries landscapes

Practica Capital plans new fund launch in 2022

Third-generation fund could be 1.5x to 2x larger than its predecessor

Leveraged loans issuance sets new record

High-yield bonds backing LBOs followed a different route, with volume decreasing 67% from Q2

Pantheon raises USD 624m for GP-led secondaries programme

Unquote recaps the fundraise and investment strategy with managing partner Paul Ward

Turkven expects Turkey Growth Fund IV final close in mid-2022

Previous fund held a final close in 2012 with capital commitments of USD 840m