Nordic unquote

eEquity, Bonnier Ventures sell Refunder to trade

eEquity exits the company three years after acquiring a majority stake in the company, and achieved a multiple of 3-5x on the transaction

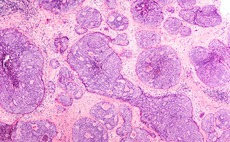

HBM Healthcare leads €127m series-B for IO Biotech

Funding follows the US Food and Drug Administration granting the company breakthrough therapy designation for its lead programmes

Alder sells Nordic Water to trade

Swiss buyer is paying €119m for the company and will see Alder and the management exit the business

Marlin and Francisco to merge Unifaun and Consignor

GPs will be equal shareholders in the combined business and own a majority stake in the company

CVC Capital Partners buys Stark Group from Lone Star

GP paid around €2.5bn for the company, deploying equity from CVC Capital Partners VII

EQT, Verdane to merge Confirmit and FocusVision

Combined company will be led by Confirmit CEO Kyle Ferguson and supported by management of both companies

Verlinvest leads €24.5m investment in Liva Healthcare

Verlinvest executive director Simon Sallustio will take a place on the company's board following the transaction

Adelis buys stake in Finnish digital learning firm Valamis

Current management will retain a significant stake in the company and continue in their roles

Unquote Private Equity Podcast: Nordic 2020 Review

Katharine Hidalgo welcomes Unquote Nordic reporter Eliza Punshi to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

VF Venture leads €9.4m investment in Reform

Company will use the proceeds for further digitalisation and accelerated growth

MB Funds to sell A-Katsastus to Finnish cooperative Tradeka

Exit comes a year and a half after the Finnish GP acquired the company from Bridgepoint, having also owned the company between 2003 and 2006

Maj Invest acquires Ferm Living from Vendis Capital

Deal reportedly values the interior design company at around €67m

Hg acquires Geomatikk

GP is deploying from its Hg Mercury 2 Fund, which held a final close on £575m in February 2017

Sanofi et al. back €47m series-B for MinervaX

MinervaX has so far raised a total of $81.5m in funding, including grants

Procuritas buys and merges Medpro and Omtanken

GP is deploying equity from Procuritas VI, which held a final close on €318m in May 2017

FSN to acquire 45% stake in Obton

GP is reportedly paying €403m for its stake, corresponding to a valuation of 25x profit for 2019

EQT Ventures, Creandum lead €1.5m seed round for Kive

AI startup will use the funding for product development and to strengthen its team in Europe

Investcorp acquires clinical trials company Sanos

GP is deploying equity from its European Buyout Fund, which held a final close on €1bn in January 2019

Latour carves out workwear brands Fristads, Kansas, Leijona

GP is acquiring the companies through its fully owned portfolio company Hultafors Group

Advent sells Faerch to trade

Deal comes three years after the GP acquired the company from EQT, reportedly paying around €1bn for it

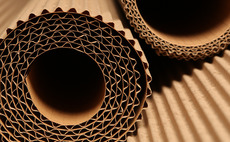

MB Funds to sell Kotkamills to trade

Sale comes five years after an MB Funds-led consortium acquired the company from Opengate Capital

Eurazeo Growth, Dawn Capital lead €85m round for Tink

Other investors include HMI Capital, Paypal Ventures, Heartcore and Opera Tech Ventures

Polaris reaps high-teens return on €1bn sale of Molslinjen

Deal is the first exit from the GP's third buyout fund

Alder to start raising new fund in H2 2021

Sponsor is currently investing from Alder II, which closed on its hard-cap of SEK 1.5bn in 2019