In Profile

LP Profile: Allianz Capital Partners

Co-head of PE Michael Lindauer speaks to Unquote about the firm's history and approach to investment

GP Profile: Lakestar

Unquote speaks to founder Hommels about the VC's future ambitions and the European venture landscape

LP Profile: Adams Street Partners

Unquote talks to Ross Morrison, partner on the primary investments team and responsible for mid- and large-cap fund investments

GP Profile: Gimv

Investor relations and corporate communications manager De Leenheer discusses the firm's history of public backing and current strategy

GP Profile: Mangrove Capital

An early backer in Skype and Wix, Mangrove held a final close on €200m for its fifth fund earlier this year

LP Profile: Stonehage Fleming

Head of PE Clarke-Jervoise discusses the multi-family office's client base, investment strategy and recent approach to GP relationships

LP Profile: Pantheon

Managing partner Ward talks to Unquote about the resurgence of separate managed accounts and shying away from first-time funds

GP Profile: Baird Capital

Partners from the firm's three regional teams discuss Baird's new global approach to capital deployment and its future plans

LP Profile: Hamilton Lane

Firm's managing directors Strang and Lei Ortiz discuss the merits of smaller relationship pools and how ESG is at the heart of its activities

LP Profile: Aberdeen Standard Investments

The LP's global head of private equity speaks to Unquote about new projects, co-investment, secondaries and first time funds

GP Profile: Deutsche Private Equity

GP has deployed 44% of its third fund within 15 months of the vehicle holding its final close on €575m

GP Profile: Triton Partners

Founder Peder Prahl talks to Unquote about the GP's turnaround approach and its funds' more pronounced J curves compared to regional peers

GP Profile: Bregal Freshstream

GP closed its maiden fund on тЌ600m and makes minority and majority investments in businesses across the UK and Benelux regions

GP Profile: Palamon Capital Partners

Pan-European mid-market GP has experienced an evolution in the mid-market space and the institutionalisation of PE as a whole

GP Profile: Bain Capital

GP is currently investing from its $3.5bn fourth European buyout vehicle, which closed in 2014

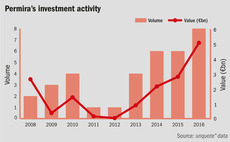

GP Profile: Permira

Global large-cap investor closed its latest buyout fund on €7.5bn in February 2016, making three investments from it to date

In Profile: Ardian

Celebrating its 20-year anniversary in 2016, the GP has differentiated over time with funds covering multiple investment approaches

In Profile: Apax Partners

GP closed its ninth fund in 2016 on its hard-cap of $9bn and recently made high-profile exits including the 2015 IPO of Auto Trader

In Profile: Duke Street restructures Fund VI

Restructure and cornerstone fund paves the way for a new hybrid model

In Profile: Rutland Partners

GP most famous for rescuing Pizza Hut talks to unquote" and explains the importance of co-investment in its Maplin deal

In Profile: Lyceum Capital

GP has deployed 70% of its third fund and will start raising its fourth in 2017

In Profile: HIG Europe

GP has been particularly active in 2016, completing five exits and two buyouts, with two further deals in the pipeline

GP Profile: Inflexion Private Equity

As part of our In Profile series, unquote" takes a look at the GP's busy 2016 and rapid-fire fundraises

In Profile: TDR Capital

GP launches its fourth vehicle, having successfully raised its annex fund earlier in 2016