Unquote Data

Swedish authorities continue to press for tax change

Sweden's tax authorities are vehemently pushing for a change in the taxation of proceeds for private equity fund managers.

Turkey rises to the challenge

Turkey is slowly but surely establishing itself as a prominent market for private equity in Central and Eastern Europe along with Russia and Poland.

Industrials and consumer see most volume in 2012 to date

The industrial and consumer sectors outperformed other major industries in terms of deal volume between January and September 2012.

The unquote" forecast: Total buyouts fall by 22% in 2012

After buyouts picked up again in 2010 and 2011, this year's forecast predicts a drop in both value and volume. Anneken Tappe reports

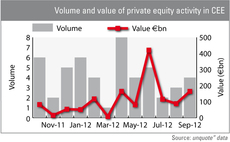

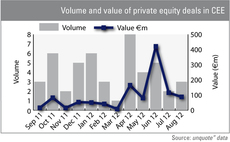

CEE picking up the pace

Dealflow in the CEE region picked up slightly in August, and the handful of deals closed so far in September hints at a busy Autumn ahead.

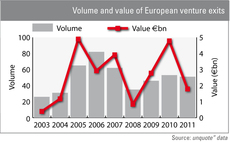

Successful exits bring venture back into the game

Venture is bouncing back since its 2008 trough, and now sees over 50 exits per year in Europe. These exits are not just about quantity, but also quality, with some of Europe's best-loved VCs sharing the limelight with lesser known players.

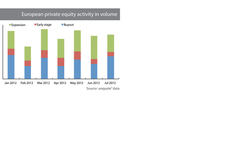

European buyout dealflow picks up in July

European private equity dealflow remained stable in July, with an increase in buyout activity making up for lackluster growth capital and early-stage investments, resulting in a significant value uptick.

Healthcare investments wane after strong Q2

Investment in the healthcare industry is facing tough times as total deal value falls to its lowest level in 18 months.

Financials regain traction in summer

After a strong start in January, investments in financials slumped in both volume and value, following a bumpy path before gaining some more traction again in July.

Europe-wide PE investment to fall below €45bn in 2012

Following a lacklustre start to 2012, Europe should see year-end buyout investment levels barely hit the €40bn mark – the first glitch in an otherwise steady recovery since 2010. Greg Gille reports

Welcome to the new look unquote.com

Welcome to the new look unquote.com

Investments by regional funds

The volume of investments backed by regional initiatives has followed the general market curve of recent years: after the boom year of 2007, they plunged.

Corporate divestments decline across Europe

As industry players remain cautious with regards to dealflow, unquote” data shows that the trend in domestic corporate divestments is heading downhill. Anneken Tappe reports

Early-stage deal rate highest in Europe

A look at early-stage activity in 2011 across Europe shows the DACH region is consistently the strongest player in the early-stage market, followed by the UK & Ireland.

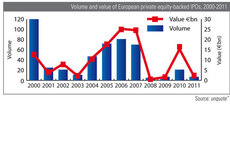

Private equity-backed IPOs, 2000-2011

In appreciation of Facebook's massive IPO last week, unquote" data shows the volume and value of private equity-backed IPOs from the dot-com bubble through the financial crisis of 08/09, up to last year.

LP caution hits life science investments

Universities can be a safe environment to raise funds and develop ideas. But it looks like university clusters are losing their pull factors in the eye of diminishing returns to investors. Anneken Tappe investigates

Trade sale values boom in 2011

Trade sales continue to be the most common exit route in 2011 and increased by almost €30bn in value, while secondary buyouts are stalling, reflecting the tough economic conditions of the past year. Anneken Tappe reports

Growth funding: is it all downhill from here?

Expansion and early-stage deal numbers declined steadily in Q3 2011, leaving the industry expecting a grim final quarter of the year. Anneken Tappe reports

Debt fears see all-equity investments wane

The economic climate should be a hotbed for all-equity investments, but the data disagrees. Anneken Tappe reports

Fund Administration Report 2011

The unquote" Fund Administration Report 2011 gives an insight into fund administration services and looks at current trends and issues in the market.

Technology activity holds up despite tough market

Tech deals have remained remarkably robust since the onset of the financial crisis, with fairly consistent deal volumes seen throughout the past few years. However, deal value has fluctuated wildly. Anneken Tappe investigates.

2011 to see €59bn by year-end – updated unquote" forecast

After a promising start, buyout activity in Europe might slow down even further in the fourth quarter of 2011, and risks falling behind last year’s levels. Anneken Tappe reports