UK unquote

Hutton Collins and LGV back Novus Leisure MBO

Hutton Collins and LGV Capital have backed the management buyout of bar and club operator Novus Leisure, which notably runs the Tiger Tiger brand.

Finance Wales et al. complete Clinithink series-A

Finance Wales has taken part in the multi-million-dollar second tranche of a series-A funding round for UK-based healthcare software company Clinithink, alongside existing investors.

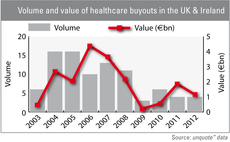

Are buyout firms well placed for healthcare reforms?

UK healthcare

LDC takes Boomerang private

LDC has acquired AIM-listed media production company Boomerang in a take-private worth close to £8m.

North West Fund backs PlaceFirst

The North West Fund for Energy & Environmental, managed by CT Investment Partners, has acquired a minority stake in UK-based energy and regeneration business PlaceFirst.

Octopus appoints new investment director

Octopus Investments has appointed Shay Ramalingam as investment director in its specialist finance division.

RCapital Partners backs bChannel MBO

RCapital Partners has supported the MBO of UK sales channel management business bChannel.

Equistone in talks for Explore Learning

Equistone Partners Europe is in exclusive talks to acquire Explore Learning, a UK-based firm offering maths and English tuition to 5-14-year-olds.

Rutland appoints investment exec

Turnaround investor Rutland Partners has appointed Michael Reynolds as investment executive.

Mobeus in £18m Tessella MBO

Mobeus Equity Partners has pumped £18m into science-focused technology and consulting services provider Tessella, marking the GP's first buyout since its spinout from Matrix Group.

Imperial Innovations in £17m round for Cell Medica

Imperial Innovations Group has invested in a £17m funding round for its portfolio company Cell Medica.

Index et al. partially exit Funxional Therapeutics

Index Ventures, Novo A/S and Ventech have partially exited their investment in Funxional Therapeutics, following the company’s sale of its rights to lead anti-inflammatory drug FX 125L to German pharmaceuticals company Boehringer Ingelheim.

August Equity's Enara makes string of acquisitions

August Equity's portfolio company Enara, a British care provider, has completed four add-on acquisitions as part of its buy-and-build strategy.

Connection Capital appoints two

UK private client firm Connection Capital has appointed Robert Clarke as head of its investment committee and Julian Carr as investment director in the private equity team.

Doughty Hanson to reshuffle partnership structure

Doughty Hanson has announced a new GP structure, including limited liability partnerships, following the death of co-founder and majority shareholder Nigel Doughty in February this year.

Arts Alliance et al. back RollUp Media

Arts Alliance and a group of individual investors have injected €1.2m into UK-based online platform for publishers RollUp Media.

OTPP looking to score Goals Soccer takeover

The Ontario Teachers' Pension Plan (OTPP) is set to buy listed UK-based Goal Soccer Centres, which operates five-a-side football centres, in a deal that values the business at around £73.1m.

Inflexion appoints new partner

Inflexion Private Equity has promoted Richard Swann from investment director to partner.

UK Watch: Smaller buyouts still growing

The UK’s smaller buyout space has gone from strength-to-strength in the second quarter of 2012, according to figures in the latest unquote” UK Watch, in association with Corbett Keeling.

Oaktree Capital buys Integrated Subsea Services

Oaktree Capital Management has acquired a 62.5% stake in Integrated Subsea Services (ISS), according to reports.

Edge backs Working Partners and Beast Quest buyouts

Edge Performance VCT has supported the two companies acquiring UK-based publishing businesses Working Partners and Beast Quest.

Lyceum-backed Access Group bolts on Delta Software

Lyceum Capital portfolio company Access Group has acquired Delta Software for £5.4m.

Revolymer IPO raises £25m

Revolymer, a British polymer company, has completed an IPO on the AIM market of the London Stock Exchange.

PE houses in final round for Pizza Hut

Risk Capital Partners, Endless and Rutland Partners are understood to be competing for Pizza Hut's UK restaurants business.