Industry

Oaktree provides €275m in financing to Inter Milan

Following the deal, Suning and LionRock pledge their stakes in the company as collateral

RBS appoints new fund finance director in Luxembourg

Bank appoints Philip Prideaux to drive its Luxembourg funds banking offering

Eurazeo to ramp up divestments over next 24 months

Firm also expects fundraising to exceed the previous record of €2.9bn set in 2020

Polaris launches flexible capital strategy with DKK 1bn fund

GP starts raising a DKK 1bn fund for the new strategy and plans to hold a first close after summer this year

Management buys majority stake in Aurica Capital

GP is currently investing its third fund, which is dedicated to growth capital investments in mid-market companies

Mobeus hires three in growth team

Investment director Joe Krancki joins from Frog Capital, where he was a partner

Q1 Barometer: Total European deal value reaches new decade high

The latest Unquote Private Equity Barometer, produced in association with Aberdeen Standard Investments, is now available to download

Creandum expands investment team in Stockholm and London

Sabina Wizander returns to Creandum as partner after spending four years at portfolio company Kry

EQT's Suse sets share price for €5bn IPO

Listing of the open-source enterprise software business is expected on 19 May 2021

Alpha appoints Zanotelli as director in Italy

In his new role, Livio Zanotelli will focus on identifying new investment opportunities across Italy

Sanne rejects Cinven's £1.3bn offer

Cinven's proposal amounts to 830 pence per share, representing a 37.6% premium to Sanne's shares price of 603 pence

Digital+ Partners gears up for fundraise

GP focuses on later-stage B2B technology companies and closed its previous fund in 2018 on €350m

Q1 DACH VC and growth deals surpass previous volume high

Deal volume has grown steadily since Q2 2019; aggregate value has also been rising since Q2 2020

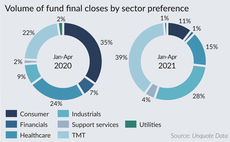

PE funds raised in pandemic increasingly target TMT opportunities

GPs' origination preferences and 2020 investment volume have already shown a clear shift to technology investments, with new fundraises following suit

Apposite Capital announces new appointments

Talent and human capital director and investment manager are among the new appointments at the UK-based GP

Hg-backed MeinAuto postpones IPO

Car sales platform cited "currently adverse conditions for high-growth companies" in a statement

ABN Amro backs ESG-linked facility for AlpInvest

Facility is for AlpInvest Co-Investment Fund VIII, with interest payments linked to ESG performance

Investec provides ESG-linked NAV facility for Bluewater

Facility is related to the portfolio of Bluewater Energy Fund I, which closed in 2013 on $861m

Debt funds celebrate strong dealflow following Covid stress-test

Direct lenders now see shift away from refinancings and towards new deals, including 2020 processes coming back to life

YielCo holds closes for PE and co-investment funds

YielCo Special Situations Europe II is targeting тЌ300m; YielCo Defensive Investments targets тЌ150m

Azimut buys 30% stake in VC house P101

With this partnership, Azimut and P101 intend to develop a European platform to fuel the growth of innovative companies

Capza appoints Gauffre as head of sustainability and impact

In her new role, Gauffre oversees the structuring and development of Capza's ESG strategy and CSR policy

Andera Partners lines up DACH expansion plans

Starting with BioDiscovery 6, the GP intends to accelerate fundraising and deal-making in the region

17Capital makes raft of senior promotions

Firm appoints new managing partner and two new co-heads of credit