Industry

Perwyn opens Paris office, eyes more investment on the continent

Firm has already made two investments in France: Isla Delice in 2018 and Keobiz in 2020

Kramer Levin hires Eversheds team for French PE, financing practices

Law firm adds five lawyers to its private equity and banking/finance practices in Paris

GP Profile: Quadrivio plots busy investment schedule for 2021

Quadrivio co-founding partner and CEO Walter Ricciotti discusses the firm's latest fundraises, portfolio performance and upcoming investment pipeline

Fundraising fortunes: prevailing LP preferences persist

Alessia Argentieri looks at the winning strategies, and gathers insight from placement specialists as to what the rest of 2021 has in store

Tikehau's SPAC Pegasus raises €500m

Tikehau, FinanciУЈre Agache, Jean-Pierre Mustier and Diego De Giorgi commit to invest a total amount in excess of тЌ165m

Dorilton launches venture strategy to target tech companies

Dorilton Ventures will lead significant minority investments in early- to mid-stage data-centric technology companies

Alantra appoints two new operating partners

In their new roles, they will support the investment team in the management of Alantra's portfolio companies

Aurelius announces UK team appointments

Simon Jobson joins the London team as a principal; Shivani Sheth joins as an investment associate

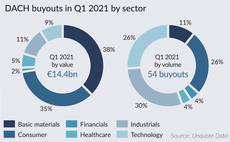

Appetite for DACH tech deals continues apace in Q1

Sponsor demand for differentiated IT services and roll-up strategies remains consistent

EQT's Suse sets out IPO plans

Enterprise software platform intends to generate net proceeds of $500m with its Q2 2021 IPO

Inflexion and Informa combine FBX, Novantas

Inflexion and Novantas will each own a minority stake in the newly formed financial data business

LP Profile: PFR increasingly eyeing funds outside Poland

Polish LP has invested €75m in four private equity firms in recent months, including Apax Partners, PAI Partners and Avallon MBO

Bowmark promotes four

Firm promotes Cheong and Elliott to partners, Keen to investment director and McRae to investment manager

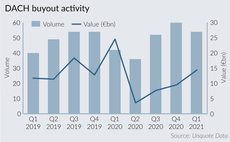

DACH buyouts continue recovery from Q2 2020 low

Both deal volume and value are now back on par with the figures for Q4 2019, prior to the pandemic

NorthEdge announces senior appointments, promotions

A chief operating officer and head of ESG are among the new appointments at the UK-based GP

Paragon-backed Apontis Pharma announces IPO intention

Paragon acquired the pharmaceutical business from its parent company UCB in 2018 via Paragon II

Hg's MeinAuto announces intention to float

Hg invested in the new car sales platform in 2018; prior backers included HV Capital and DN Capital

Patrimonium hires Mogwitz

Ulrich Mogwitz joins the firm's private equity team from impact investor Prorsum

Verdane appoints sustainability expert Osmundsen as partner

Erik Osmundsen will be responsible for strengthening Verdane's capabilities in sustainability

Van den Ende sells stake in Endeit Capital

Partners Hubert Deitmers and Martijn Hamann will now be the sole owners of the firm

Unquote Private Equity Podcast: Onwards and upwards for Jersey

The Unquote Private Equity Podcast welcomes back Jersey Finance to discuss what the jurisdiction can offer private equity GPs

Searchlight hires new global head of value creation

Amanda Good joins from Hg as partner; she has prior experience with Bain & Company

PE-backed diagnostics firm Synlab announces IPO pricing

Shares will be priced at €18-23, equating to a €4-5bn market capitalisation and €5.9-6.9bn EV

Aurelius appoints Dränert in Wachstumskapital division

Markus Dränert will focus on software and technology investments, joining from his role at Finleap