Articles by Eliza Punshi

IK sells minority stake in Third Bridge to Astorg

IK Investment Partners has entered into an agreement to sell its minority stake in Third Bridge to French private equity firm Astorg.

eEquity, Bonnier Ventures sell Refunder to trade

eEquity exits the company three years after acquiring a majority stake in the company, and achieved a multiple of 3-5x on the transaction

Holland Capital invests in Intercept

Company will use the capital injection to scale up its product development and expand internationally

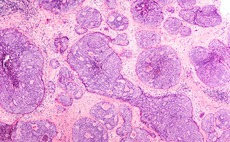

HBM Healthcare leads €127m series-B for IO Biotech

Funding follows the US Food and Drug Administration granting the company breakthrough therapy designation for its lead programmes

BlackRock et al. back Immunocore in $75m series-C

Biotech company has raised $620m in equity and debt since being founded in 2008

Alder sells Nordic Water to trade

Swiss buyer is paying €119m for the company and will see Alder and the management exit the business

Marlin and Francisco to merge Unifaun and Consignor

GPs will be equal shareholders in the combined business and own a majority stake in the company

CVC Capital Partners buys Stark Group from Lone Star

GP paid around €2.5bn for the company, deploying equity from CVC Capital Partners VII

EQT, Verdane to merge Confirmit and FocusVision

Combined company will be led by Confirmit CEO Kyle Ferguson and supported by management of both companies

Sofinnova et al. in €35m series-C round for CorWave

Company has so far raised €80m in funding since being founded in 2012

Flexstone Partners appoints head of ESG

Gibert, who joined Flexstone Partners in 2014 and is based in Paris, will take on the new role in addition to her existing responsibilities

Holland Capital invests in media agency Purple

GP is currently investing from its Holland Capital Growth and Buyout Fund IV, which held a first close last June on €117m

Unigrains secures minority stake in Innatis

GP has also backed Innatis's acquisition of Domaine des Coteaux, a producer of peaches, nectarines, apricots, cherries and kiwis

IK buys LSA from BlackFin

BlackFin exits the company five years after wholly acquiring it, then operating as Lucheux

PAI buys MyFlower from LFPI and Montefiore

GP is deploying equity from its latest vehicle, PAI Mid-Market fund, which held a first close in October 2020

Adelis buys stake in Finnish digital learning firm Valamis

Current management will retain a significant stake in the company and continue in their roles

Weinberg Capital buys supermarket chain Marcel & Fils

GP is deploying equity from its third fund, and Marcel & Fils is its fourth investment from the vehicle

Evoco carves out six industrial companies from Gesco

GP is deploying equity from its third fund, Evoco TSE III, which held a first close in June 2020 on €93m and is targeting €150m

VF Venture leads €9.4m investment in Reform

Company will use the proceeds for further digitalisation and accelerated growth

Aksia in exclusive talks to acquire MIR – report

De'Rossi & Associati is reportedly acting as a legal adviser to MIR, while Mediobanca is running the process

MB Funds to sell A-Katsastus to Finnish cooperative Tradeka

Exit comes a year and a half after the Finnish GP acquired the company from Bridgepoint, having also owned the company between 2003 and 2006

Maj Invest acquires Ferm Living from Vendis Capital

Deal reportedly values the interior design company at around €67m

Latour sells Nextpool to B&Capital-led consortium

GP sells its stake six years after acquiring it via Latour Capital I in December 2014

Hg acquires Geomatikk

GP is deploying from its Hg Mercury 2 Fund, which held a final close on £575m in February 2017