Industry

Altor launches DACH office

Altor recently held the final close of its Altor Fund V on its hard-cap of €2.5bn

US investors eye European first-time funds

Maiden fundraises are maintaining momentum, with US institutional investors increasingly drawn to such vehicles

Private investor platform Truffle Invest offers first PE fund

Platform launched in September last year and has already backed a VC fund with private funds

ATP records loss despite strong PE returns

DKK 785bn fundтs performance took a hit from investments in the global equity markets

Ardian hires Friedrich to join buyout team

Alexander Friedrich joins from Quadriga Capital, where he led the services and software sector teams

Adams Street hires de Beau for primary investments team

Responsibilities include managing private equity fund manager relationships throughout Europe

SEB Investment Management appoints new CEO

Ragnartz joins from pension company AMF, where she worked as head of asset management

Q4 Barometer: European deal volume sets new annual record

Despite a slowdown in the final quarter of the year, private equity activity reached an all-time high over the course of the year

Freitag promotes Prüfer to managing partner

Prüfer spent time at Macquarie and HBA-Consulting before joining Freitag & Co in 2011

Ex-AP6 exec Erik Nobel launches LLCP Stockholm office

Erik Nobel is in charge of establishing and managing the newly established office in Stockholm

Advent hires former TPG partner Taylor as head of tech

Taylor previously co-founded Symphony Technology Group and was a consultant at Bain & Company

Fondazione Enasarco seeks new CIO

Unquote understands that Enasarco is seeking an external candidate to fill in the position

Tenzing recruits Inflexion's Healy, makes two further hires

GP has hired former Inflexion TMT partner Healy, as well as Phoenix's Sims and Deloitte's Nicholson

HIG hires Pamplona's Noé-Nordberg as MD

New recruit will head up the firm's recently launched European mid-market division

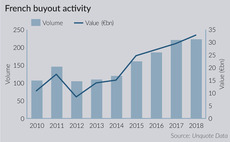

French buyout value climbs to post-crisis peak

Total deal value comfortably surpasses 2017's figure in a market driven by fierce competition, high prices and easy access to debt

MJ Hudson opens new office in Milan

Italian branch MJ Hudson Alma will focus on fund formation and financial regulatory mandates

Video: EIF's Panier talks fundraising, succession

Denise Ko Genovese interviews EIF's head of European lower-mid-market equity investments at the IPEM conference in Cannes

Main Mezzanine spins out as Pride Capital

As Pride Capital, the rebranded mezzanine provider will maintain the same investment strategy

DC hires Luycx from Torch Partners

Luycx joins from Torch Partners, where he worked for 10 years, latterly as managing director

Goodwin hires Latham & Watkins' Klenk

Goodwin hires private equity and M&A lawyer Gregor Klenk as a partner in its Frankfurt office

Private equity drives returns for ABP

Private equity has been the best performing asset class though the year, followed by infrastructure

Video: Ambienta's Tronchetti Provera on sustainability trends

Greg Gille catches up with the Ambienta managing partner and founder at the IPEM conference

Unquote Private Equity Podcast: Minority report

Listen to the latest episode of the Unquote Private Equity Podcast, in which our Precogs envision PE's future of non-controlling stakes

AnaCap credit fund invests in €4bn loan portfolio

First investment from AnaCap Credit Opportunities Fund IV, which held a first close in November