Fondo Italiano di Investimento

Fondo Italiano and EdRIP back Unitedcoatings Group

Fondo Italiano di Investiment and Edmond de Rothschild Investment Partners (EdRIP) have injected €20m into coatings company Unitedcoatings Group.

Special Report: Italy

Special Report: Italy

Italian association introduces graduates to the industry

Italian private equity and venture capital association AIFI is to hold a conference in October to introduce young people to the industry.

Star Capital SGR holds first closing

Italian investor Star Capital SGR has held a first closing on more than €70m for Star III, a fund aiming to back Italian SMEs.

Fondo Italiano backs Megadyne

Fondo Italiano di Investimento has invested €20m in Italian belts and pulleys manufacturer Gruppo Megadyne in exchange for a minority stake.

Fondo Italiano provides capital to Hat Holding

Fondo Italiano di Investimento has committed capital to Italian investment company Hat Holding, allowing the firm to shift its focus from club deals to investments from a closed-end fund.

The State at play: Italian government jumpstarts flat market

The State at play

Fondo Italiano injects €5m into Antares

Fondo Italiano di Investmento has acquired a minority stake in Italian artificial vision systems producer Antares Vision via a €5m investment in holding company Imago Technologies.

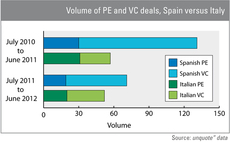

Spain continues to outperform Italy in deal volume

Despite the country's dire economic state, Spanish private equity activity has continued to outpace that of Italy continuously over the past 24 months - although the latter showed more resilience last year.

Fondo Italiano invests €10m in EMARC

Fondo Italiano di Investimento has injected €10m into italian industrial group EMARC in exchange for a minority stake.

Fondo Italiano backs General Medical Merate

Fondo Italiano di Investimento has injected €13m into radiology equipment producer General Medical Merate in exchange for a minority stake.

Fondo Italiano backs Labomar

Fondo Italiano di Investimento has injected €5.5m into Italian dietary supplements producer Labomar in exchange for a minority stake.

AIFI announces new board

Italian private equity and venture capital association AIFI has announced its new governing board.

Comecer acquires Brita Trade

Fondo Italiano portfolio company Comecer has acquired Brita Trade, a Czech glass processing firm.

Fondo Italiano backs Angelantoni Test Technologies

Fondo Italiano di Investimento has made an €8m equity investment in exchange for a minority stake in Angelantoni Test Technologies, which provides testing equipment and services for use on mechanical and electrical systems and products.

Fondo Italiano backs Farmol

Fondo Italiano di Investimento has invested €11.25m in Bergamo-based aerosol company Farmol in exchange for a minority stake.

Concerns over "unfair" Fondo Italiano

Italy’s Fondo Italiano has been on a roll in recent weeks, completing five deals in just seven days over the festive period. But mid-market professionals in Italy are concerned the government-backed fund could be introducing unfair competition. Amy King...

Fondo Italiano to invest in venture capital funds

Fondo Italiano di Investimento has pledged to boost start-up growth in Italy by investing in venture capital funds. The fund is set to make investments of up to €50m from its €1.2bn of assets under management to help young Italian companies grow.

Fondo Italiano-backed Arioli acquires Brazzoli

Fondo Italiano di Investimento has reinvested in textile machinery manufacturer Arioli to facilitate the company’s acquisition of 100% of Brazzoli, a manufacturer of textile dyeing machines. Varese Investimenti provided co-investment.

Fondo Italiano invests €20m in Zeis Excelsa

Fondo Italiano di Investimento has invested €20m in footwear and clothing supplier and manufacturer Zeis Excelsa SpA.

Fondo Italiano backs Rigoni di Asiago

Fondo Italiano di Investimento has completed its 16th transaction to date with a €14m investment in organic fruit confectionery and spreadable goods producer Rigoni di Asiago.

Fondo Italiano makes €20m investment in TBS

Fondo Italiano di Investimento has invested €20m in integrated clinical engineering and health services provider TBS Group. The public-private government-backed vehicle has acquired a 13.17% stake in the listed company through a capital injection of €10m...

Fondo Italiano injects €12m into Sira Group

Government-backed vehicle Fondo Italiano di Investimento has backed steel, aluminium and die-cast radiator producer Sira Group SpA with €12m in exchange for a minority stake.

Fondo Italiano invests in Gruppo La Patria

Fondo Italiano di Investimento and PM & Partners have made an equity investment in security services provider Gruppo La Patria.