Market Insight

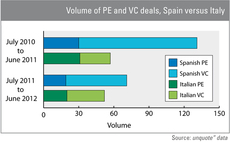

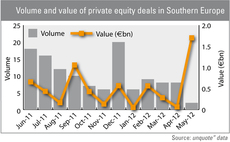

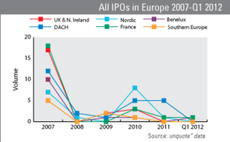

Spain continues to outperform Italy in deal volume

Despite the country's dire economic state, Spanish private equity activity has continued to outpace that of Italy continuously over the past 24 months - although the latter showed more resilience last year.

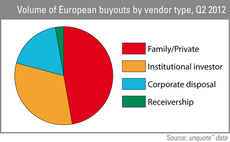

SBOs remain resilient in Q2

The increase in larger deals witnessed in the second quarter corresponded with a relative resilience in secondary buyout activity across Europe, according to the latest unquote" Private Equity Barometer.

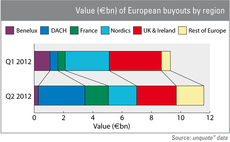

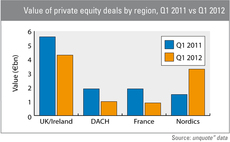

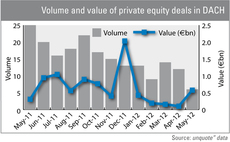

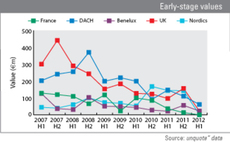

DACH buyout market outweighs neighbours in Q2

Buyouts in the German-speaking region have shown a significant gain in value from the first to the second quarter of 2012, enabling the region to top the regional aggregate value table.

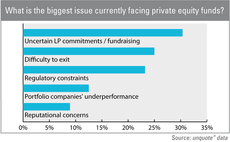

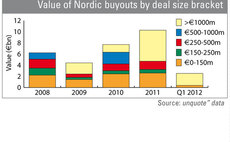

Fundraising a chief concern for Nordic PE professionals

While the AIFM Directive was on everybody's agenda last year, fundraising is the main concern for most of the private equity practitioners polled in the latest unquote" Nordic Survey.

Dealflow: Tech more resilient than pharma

While overall activity declined gradually between Q1 2011 and Q2 2012 as macroeconomic conditions worsened, dealflow in the technology sector proved to be much more resilient than pharmaceuticals. This holds for both overall European and country-specific...

UK support services boom in Q1 2012

The support services sector performed well in Q1 of 2012, raising expectations of strong growth for the remainder of the year.

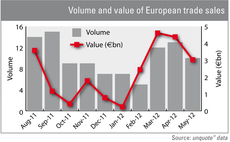

Trade sales on the rise

The partial sale of Alliance Boots to Walgreens by KKR and AXA PE is the latest in a series of exits propping up trade sale figures in 2012. Meanwhile the secondary buyouts trend is showing signs of abating. Greg Gille reports

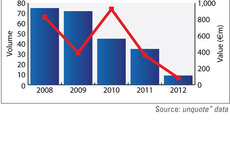

Europe-wide PE investment to fall below €45bn in 2012

Following a lacklustre start to 2012, Europe should see year-end buyout investment levels barely hit the €40bn mark – the first glitch in an otherwise steady recovery since 2010. Greg Gille reports

Big boost in Spring dealflow

Nordic activity rebounded sharply in May as nine deals worth an estimated €1.4bn were recorded: more than double the volume, and more than four times the value of the previous month.

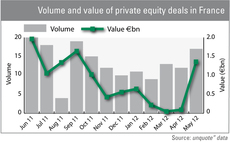

French activity: Out of the trough?

Shored up by an uptick in mid-market buyout activity, French dealflow has shown encouraging signs of recovery in May. But subdued activity in the first months of 2012 and a lack of visibility on macro-economic trends should take their toll on year-end...

UK and Nordics outperforming rest of Europe

Research from unquote” data finds that the UK/Ireland has not only outperformed its continental European counterparts in Q1 of 2012, but it was also the only region to raise deal volume levels above those of 2011.

Southern Europe: Volume drops, value soars

Deal activity remained particularly subdued across Southern Europe in May, although the Rottapharm buyout in Italy sent overall value soaring.

France: acquisition finance off to good start in 2012

The overall value of French PE-backed acquisition finance deals completed in the first months of this year has already exceeded 2011 year-end figures. Recent research also highlights that French businesses remain hungry for build-up opportunities.

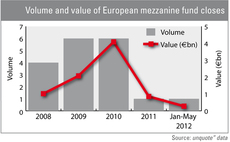

Are mezzanine funds making a comeback?

The launch of 123 Venture’s latest mezzanine fund, the €100m Trocadero Capital Transmission II, is the second mezz fund launch this year with CIC Mezzanine III. In parallel, the number of mezzanine funds reaching final close has declined from 6 in 2010...

DACH investment leaps forward in May

Investment in the DACH region surged forward in May, with seven deals worth an estimated €580m, compared to 12 deals worth just €100m in April.

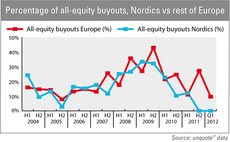

Nordic credit remains more readily available

The Nordic countries have enjoyed a lower proportion of all-equity buyouts than the rest of Europe for several months now - highlighting easier access to leverage in the region.

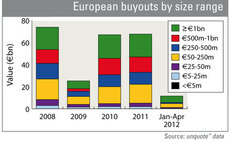

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

Buyout market could see worst year since 2009

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

SBOs set to rebound

The recent quaternary buyout of French eyewear retailer Alain Afflelou by Lion Capital for an estimated €780m shows that the "pass-the-parcel" trend in private equity has not yet abated.

Nordics seen as investment safe haven

The тЌ1.8bn sale of Ahlsell to CVC Capital Partners in February drew renewed attention to the thriving Nordic buyout market.

University and college spinouts make a timid rebound

The funding of Arvia, a spinout from the University of Manchester's School of Chemical Engineering, by MTI Partners for £3.8m is the latest of nine university spinouts noted since the year started.

Declining activity belies venture successes

Although European venture capital activity decreased by 12% to €974m last year, 2011 saw a number of sizeable fund closes as well strong exits, indicating fresh appetite for the asset class.

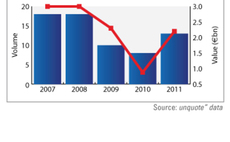

Europe's IPO comeback

Private equity-backed IPOs have had a rollercoaster ride in Europe over the last five years.

CEE's mid-market boom

CEE activity was subdued but with encouraging signs in 2011. Q1 saw just €1.7bn clocked up, but this was twice the sum of the whole of the previous year. Also, although activity in H2 was quiet, year-end figures nearly doubled to €2.6bn year-on-year....