Unquote Data

Multiples Heatmap: TMT deals inked in Q3 pass 19x mark

Average entry multiples were again pushed into record territory in Q3 on the back of a still-buoyant M&A market

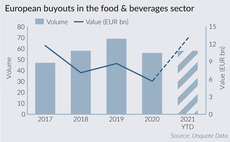

Food and beverage buyouts to reach EUR 13bn in 2021

An average of 44 buyouts totaling EUR 5.1bn were completed in the sector from 2011-2020

Announced PE deals fall sharply in October

Could the market have finally reached full capacity following a record-breaking first half of 2021 for M&A?

Consumer dealflow rebounds strongly in Q3

More on-trend verticals such as technology and healthcare took a backseat in the third quarter, Unquote Data shows

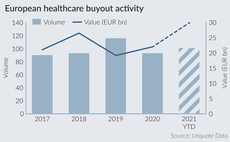

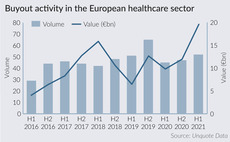

Healthcare buyouts approach record EUR 30bn in 2021

France has been the source of more than half of the aggregate value recorded to date

DACH VC deal value doubles year on year

VCs have backed DACH region deals with an aggregate value of EUR 15.4bn in 2021 to date

2021 European PE exits already exceeding full 2020 tally

GPs are clearly looking to seize the initiative and clear out portfolios amid a general push to ink deals on the buy-side

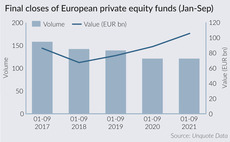

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate

European PE activity could reach EUR 400bn mark in 2021

Aggregate value for 2021 to date is already higher than that seen in any full-year on record, with a full quarter still to play out

French mega-rounds shoot up in 2021

France has already seen as many rounds of EUR 100m and above than in 2019 and 2020 combined, Unquote Data shows

Q2 Barometer: Robust Q2 performance bodes well for H2

The latest Unquote Private Equity Barometer, produced in association with Aberdeen Standard Investments, is now available to download

Multiples Heatmap: PE continues to pay ever more for assets

Deal multiples record a fifth consecutive quarterly increases to reach 11.8x in the second quarter of 2021

No sign of summer holiday for PE as dealflow beats records

In June and July 2021, deal volume surpassed 2019's record by 13%, with aggregate value up by 33%

Valar Ventures leads USD 263m round for Bitpanda

Round brings the aggregate value of growth and VC deals in Austria in 2021 to more than EUR 1bn

Mega-rounds fuel record H1 for venture and growth

Largest rounds inked in the first six months of 2021 read like a veritable Who's Who of European fintech heavyweights

PE buy-side appetite further boosts exit options for sponsors

Secondary buyouts accounted for nearly a third of all PE exits in the first half of 2021, compared with typical levels of 20-25%

Nordic buyout deal volume peaks in H1 2021

Dealflow was more than double that seen in H1 last year, and up 25% on the first half of 2019

UK buyout activity cools off in second quarter

While buyout activity fell more sharply in the UK compared to other European markets in Q2, dealflow remained very strong by historical standards

French buyout market continues strong rebound in H1

France was home to nine €1bn+ buyouts, comfortably outpacing the UK and German markets

Fundraising Report 2021: mapping out the post-Covid landscape

Unquote analyses key trends and presents proprietary data on the European fundraising market

European PE buyout activity sets new record in H1

Hectic first quarter drove an unprecedented spike in deal activity, while aggregate value is just shy of hitting an all-time high

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

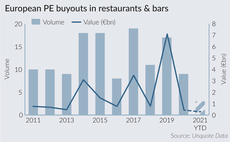

Pandemic sinks dealflow in restaurants & bars to 10-year low

Activity in the sector has not yet returned to previous levels, with four buyouts totalling тЌ285m recorded to date in 2021