Unquote Data

Nordic H1 VC and growth deal value at all-time high

Nordic venture capital and growth investment has recorded its highest aggregate deal value in the first six months of a year

Multiples Heatmap: hectic Q1 further fuels valuation hike

Deal multiples saw four consecutive quarterly increases to reach 11.5x in the first quarter of 2021

Funds maturing in 2021: what is still in PE and infra portfolios

Unquote and Inframation delve into seven of the largest funds maturing around 2021 to highlight potential M&A and secondaries opportunities

PE-backed IPOs on track for best year since 2017

This year has already seen 26 portfolio companies listing, with a total offering volume approaching тЌ12.7bn

Q1 Barometer: Total European deal value reaches new decade high

The latest Unquote Private Equity Barometer, produced in association with Aberdeen Standard Investments, is now available to download

Q1 DACH VC and growth deals surpass previous volume high

Deal volume has grown steadily since Q2 2019; aggregate value has also been rising since Q2 2020

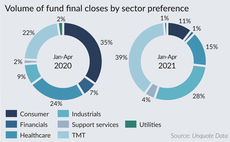

PE funds raised in pandemic increasingly target TMT opportunities

GPs' origination preferences and 2020 investment volume have already shown a clear shift to technology investments, with new fundraises following suit

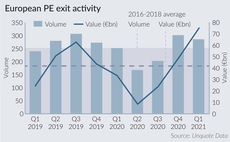

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

Fundraising fortunes: prevailing LP preferences persist

Alessia Argentieri looks at the winning strategies, and gathers insight from placement specialists as to what the rest of 2021 has in store

VC-backed Darktrace lists on LSE

Cybersecurity platform has a market cap of around ТЃ1.7bn; it raised its first funding round in 2013

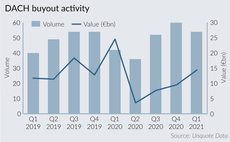

DACH buyouts continue recovery from Q2 2020 low

Both deal volume and value are now back on par with the figures for Q4 2019, prior to the pandemic

Tech overtakes consumer in Italy

Numerous Italian GPs with a generalist approach have reshaped their activity towards the tech sector

Buyout rankings: who invested the most in Europe in Q1 2021?

Unquote tallies the top 10 most active GPs across the European buyout space in the first quarter

UK buyout rankings: who invested the most in Q1

Unquote tallies the top 10 most active GPs across the UK buyout space in an exceptionally busy first quarter

KPS to buy Crown's EMEA tinplate packaging business

European packaging sector buyouts in 2021 already exceed the aggregate value recorded in 2020

Quiet market for final closes in Q1, as backlog of funds on the road grows

The number of final closes for European PE funds was down by 22% year-on-year in Q1 2021

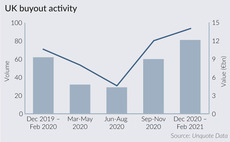

UK buyout activity sets new record in Q1

UK buyout market is truly back in full swing, according to preliminary figures from Unquote's proprietary database

Q4 Barometer: How European activity returned to pre-pandemic level

European PE deal value staged an impressive recovery over the course of 2020, capped by a busy Q4

UK & Ireland Fundraising Pipeline - Q1 2021

Unquote rounds up the most notable fundraises currently ongoing in the UK & Ireland market across the buyout, venture and debt spaces

European fund launches off to slow start in 2021

Number of PE funds launched by European managers in Q1 this year is significantly down on the volume recorded for the same period in 2020

Quantifying PE's appetite for recurring revenue models

Buyouts in sectors where recurring revenue models are predominant went from 8% of European volume in 2010 to 22% in 2021 to date

How UK PE buyouts soared ahead of 2021 Budget

Amount of dealflow in the past three months is significantly higher than in previous December-February periods

Multiples Heatmap: average pricing hits 11x in busy Q4

Healthcare, financial services and TMT assets continue to drive valuations up, while Nordic and UK regions see highest multiples

DACH exit rebound expected in H2 2021

DACH PE players completed 16 exits in January 2021, compared with 14 in January 2020, hinting at signs of a gradual recovery