Data Snapshot

No sign of summer holiday for PE as dealflow beats records

In June and July 2021, deal volume surpassed 2019's record by 13%, with aggregate value up by 33%

Mega-rounds fuel record H1 for venture and growth

Largest rounds inked in the first six months of 2021 read like a veritable Who's Who of European fintech heavyweights

PE buy-side appetite further boosts exit options for sponsors

Secondary buyouts accounted for nearly a third of all PE exits in the first half of 2021, compared with typical levels of 20-25%

Nordic buyout deal volume peaks in H1 2021

Dealflow was more than double that seen in H1 last year, and up 25% on the first half of 2019

UK buyout activity cools off in second quarter

While buyout activity fell more sharply in the UK compared to other European markets in Q2, dealflow remained very strong by historical standards

French buyout market continues strong rebound in H1

France was home to nine €1bn+ buyouts, comfortably outpacing the UK and German markets

European PE buyout activity sets new record in H1

Hectic first quarter drove an unprecedented spike in deal activity, while aggregate value is just shy of hitting an all-time high

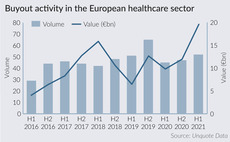

Healthcare buyout value hits new high in first half

Trio of mega-buyouts push the aggregate value of deals to тЌ19.5bn in H1, versus тЌ11bn in H2 last year

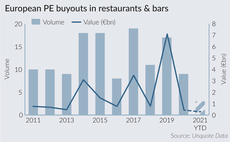

Pandemic sinks dealflow in restaurants & bars to 10-year low

Activity in the sector has not yet returned to previous levels, with four buyouts totalling тЌ285m recorded to date in 2021

Nordic H1 VC and growth deal value at all-time high

Nordic venture capital and growth investment has recorded its highest aggregate deal value in the first six months of a year

PE-backed IPOs on track for best year since 2017

This year has already seen 26 portfolio companies listing, with a total offering volume approaching тЌ12.7bn

Q1 DACH VC and growth deals surpass previous volume high

Deal volume has grown steadily since Q2 2019; aggregate value has also been rising since Q2 2020

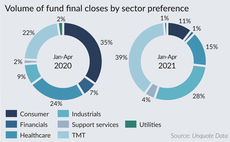

PE funds raised in pandemic increasingly target TMT opportunities

GPs' origination preferences and 2020 investment volume have already shown a clear shift to technology investments, with new fundraises following suit

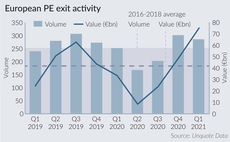

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

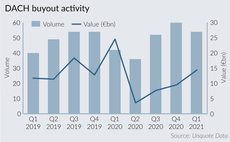

DACH buyouts continue recovery from Q2 2020 low

Both deal volume and value are now back on par with the figures for Q4 2019, prior to the pandemic

Tech overtakes consumer in Italy

Numerous Italian GPs with a generalist approach have reshaped their activity towards the tech sector

Buyout rankings: who invested the most in Europe in Q1 2021?

Unquote tallies the top 10 most active GPs across the European buyout space in the first quarter

SBOs, mega-deals fuel strong Q1 for French buyouts

While the sharp quarter-on-quarter rebound of late 2020 was not replicated, the French market remained buoyant in Q1

UK buyout rankings: who invested the most in Q1

Unquote tallies the top 10 most active GPs across the UK buyout space in an exceptionally busy first quarter

Quiet market for final closes in Q1, as backlog of funds on the road grows

The number of final closes for European PE funds was down by 22% year-on-year in Q1 2021

UK buyout activity sets new record in Q1

UK buyout market is truly back in full swing, according to preliminary figures from Unquote's proprietary database

European fund launches off to slow start in 2021

Number of PE funds launched by European managers in Q1 this year is significantly down on the volume recorded for the same period in 2020

Quantifying PE's appetite for recurring revenue models

Buyouts in sectors where recurring revenue models are predominant went from 8% of European volume in 2010 to 22% in 2021 to date

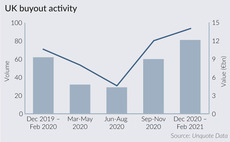

How UK PE buyouts soared ahead of 2021 Budget

Amount of dealflow in the past three months is significantly higher than in previous December-February periods